Business

You probably first heard of Viberate a few years ago, when it got written up along with the wave of blockchain companies based in Slovenia, with its key selling point being “music”. But while most of those of other start-ups failed to deliver on their promises, and many have simply disappeared, Viberate continues to develop and grow, with over 100 people working around the world on a variety of projects.

These are all based on a love of music, an understanding of the data associated with the business, and the value that can be added from analysing and applying it. In addition to working with industry professionals in the "live part" of the business (meaning musicians, festival organizers, venues, event promotors), Viberate also offers the Tonight Nightlife Guide app (Android and IoS), which in less viral times helps you plan a top night out in the various party cities of Europe, and a service to help music festivals develop their own apps. In short, it’s an exciting company, based in Ljubljana and going out into the world, one that’s well worth checking in on if you haven’t done so in a while.

Stay home and party with Umek, Slovenia’s own superstar DJ and one of Viberate’s founders

But why are we writing about a company that helps promote live shows when there are no live shows being planned? That’s because the good folk at Viberate, true to their flexible and dynamic origins have wasted no time to adapt to the new reality. They’ve set up Sick Festivals, a website that tracks which music festivals around the world have been cancelled or postponed, covering events in Europe, Asia, the Americas, Africa and Oceania. You can find it here, and in doing so reintroduce yourself to a Slovenian business that can help you plan your next big night out, whenever that is. And if you’re part of the live music industry then why not follow them on Facebook and keep an eye out some new solutions and features that Viberate is developing to help soften the impact of the current situation, which we’ll also report here when ready for release.

STA, 23 March 2020 - The coronavirus crisis will have a huge impact on Slovenia's and Europe's economies and monetary policy measures will be commensurate to the gravity of the situation. Equally important will be decisive and fast fiscal policy action, Boštjan Vasle, the governor of Slovenia's central bank, told the STA.

"It is clear at this moment that the effects of coronavirus on our economic growth will be enormous," Banka Slovenije governor Vasle said, adding that estimates about the scope of the contraction will only be possible once the health situation calms down.

Vasle said monetary policy measures in the eurozone had been taken with the awareness of how serious the situation is. "Their most important message is that they are adjusted to the scope of damage that will occur. This will remain so in the future."

The European Central Bank (ECB) and national central banks in the Eurosystem have increased asset purchases in the framework of existing programmes and added a EUR 750 billion asset purchase instrument last week.

"Add together the value of these measures and we're talking about almost a thousand billion euro at the level of the eurozone. For comparison, Slovenia's GDP is around EUR 46 billion."

This is a clear signal that monetary policy is aware of the gravity of the crisis and that central banks are capable of fast and effective action. The ECB's governing council will keep a close eye on the situation and use all instruments at its disposal for additional action if necessary, he said.

If the response to this health crisis is to be successful, coordinated action of all economic policies in a country is necessary along with concerted action by domestic and EU institutions.

The ECB's governing council therefore believes that fiscal policy must respond with equal determination and perhaps even more decisively than monetary policy, according to Vasle.

"Slovenia must bear in mind the experience of the previous crisis. This experience says countries which had reacted fast were more successful and in some cases subject to fewer of the restrictions that were put in place after the initial period of action."

Slovenia's fiscal policy action is constrained by a constitutional fiscal rule. The government has repeatedly said it would take advantage of the built-in flexibility of the constraints and Vasle likewise noted that the existing rules have exemptions for extraordinary circumstances. "It would not make sense not to take advantage of that."

Turning to the state of the Slovenian banking system, Vasle said that banks were in better shape than they had been when the financial crisis erupted.

They are sufficiently capitalised and the structure of their financing is significantly different in that it is based on deposits; equity is seven times the size of non-performing loans, which improves resilience to the current shock.

Neither do banks have packages of non-performing loans on their portfolios - which had been a part of the reason why the previous crisis was so deep - while companies are financially stronger and better equipped to absorb the crisis.

Overall the liquidity of the banking system is good, with EUR 5.7 billion in primary liquidity and EUR 7.7 billion in secondary liquidity that banks may activate by selling liquid investments or by leveraging them for monetary policy measures.

"Despite the good starting point, the crisis will of course reflect on banks as well," said Vasle, adding that the impact would strongly depend on the duration of the extraordinary circumstances and the effectiveness of mitigation measures.

The fundamental objective of Banka Slovenije action within the eurozone system and in the framework of cooperation with the government is therefore to design measures that will make it possible to quickly overcome the crisis and return back to normal operations as soon as possible.

The Slovenian parliament last week passed an emergency law deferring loan payments. Banks will be obligated to grant creditors deferral, which Vasle said would eliminate uncertainty among companies and households as to how they can act in the event they are unable to meet their loan obligations.

Asked about the financial impact of this measure on banks, Vasle said it would depend on how the pandemic develops and how long it lasts. Banka Slovenije has tested even exceptionally unfavourable scenarios and determined that even in this case the measures would be financially acceptable.

But Vasle stressed that this was merely the first tier of action as coordination efforts were already under way at eurozone level to make sure such deferral of interest and principal payments do not affect bank operations.

"It is important here to assure all banks that the measures which they adopt during the crisis will affect all eurozone banks the same way. This is the only way to avoid banks in an individual country having an advantage," he said.

The third tier of action involves additional guarantees that the state could provide, for example via SID Banka, the Slovenian export and development bank, which would additionally reduce uncertainty for the people and companies.

"It is my estimate that a solution will soon be presented to the public. At this moment a legislative solution that would make this possible is already being prepared."

All our stories on coronavirus and Slovenia are here

STA, 18 March 2020 - The Italian owners of the Slovenian subsidiary of the banking group Unicredit confirmed on Wednesday the allocation of EUR 22.8 million out of EUR 45.1 million in last year's distributable profit for dividends, meaning EUR 4.67 gross per share. The remainder will remain undistributed.

The Unicredit shareholders were also notified of the supervisory board changes - the term of five supervisors is to expire on 4 April, Pasquale Giamboi and Andrea Cesaroni will remain on the board for another term, while other three supervisors will be replaced by Enrica Rimoldi, Giorgiana Lazar O'Callaghan and Fabio Fornarolli.

Unicredit Slovenia also endorsed a multi-annual development plan for the period up to 2023 at today's meeting.

Last year, Unicredit Banka Slovenija and Unicredit Leasing generated EUR 79 million in operating revenue, a 0.5% increase year-on-year. Meanwhile, net interest revenue dropped by 8.2% to EUR 46 million compared to 2018.

The Italian banking group Unicredit generated EUR 3.4 billion in net profit, down almost 18% year-on-year. The group's revenue saw a downturn as well, with the management attributing poorer business results mostly to a drop in net interest revenue.

STA, 17 March 2020 - Boxmark Leather, the Kidričevo-based maker of car upholstery, plans to launch production of protective face masks for Slovenia next week. CEO Marjan Trobiš told the STA on Tuesday the launch of production depended mainly on the supply of material, the machines are ready.

"At the moment, the demand is the highest for masks, since there are thousands of people who need to wear them for protection and self-protection at work. Every country is protecting its interests and does not allow exports of these products, so we decided to help our country," Trobiš said.

Boxmark will produce the masks for the state only, not for the market, he added.

The company plans to use all the material that will be delivered but Trobiš could not tell how many masks that meant.

In the coming days, a large part of other production lines, for textile, and automotive and aviation industries, will grind to a halt, so all resources will be used to make protective gear for the state.

The company has introduced several protective measures during the coronavirus epidemics. It has reduced its production capacity by some 30%. The most vulnerable groups of workers, including the elderly, those with chronic conditions and mothers of small children were temporarily sent home.

"The safety of the people comes first, so we will step up the measures this week and send more people home. Thus we will maintain sustainable production, but if supply chains do not allow us to work we will systematically cease operations," he said.

Companies with hundreds of employees cannot close overnight, Torobiš said, noting that preparations for the epidemic had been under way at the company for a month so as to be able to stay in business after the epidemic.

Boxmark, which is in foreign ownership, announced restructuring at the beginning of the year, with measures affecting 900 employees. Recently more than 200 workers were made redundant and more redundancies were planned by the end of April, when the process was expected to wrap up.

All our coronavirus stories are here

There’s a petition going around to encourage the government to provide help for the self-employed, and specifically those making less than €20,000 a year, and those making less than the minimum salary. It’s easy to sign, has drawn a lot of attention and may already be having an effect. As of last night (16 March) the news was “the Economy Ministry is preparing measures to help self-employed affected by the coronavirus epidemic in Slovenia as part of a bill to subsidy pay of temporarily laid-off employees. Social security contributions payments for sole proprietors are to be deferred” – with the full story here.

So things look good, but if you think this is a worthwhile initiative then why not add to the pressure by clicking here and adding your name. The accompanying text is in Slovene, but plays well with Google Translate, as seen below:

There are more than 100,000 self-employed in Slovenia, which is more than 12% of the working population. With the crippling public life and economic downturn, many of them have already been hit hard by the coronavirus epidemic, as they have lost their jobs, which will also cause them difficulties in settling compulsory social security contributions.

We appeal to the Government to take immediate action with two forms of assistance from 1 March 2020 until the official declaration of the end of the epidemic and the restoration of public, economic and cultural life.

1. Exemption from the payment of compulsory social security contributions

Self-employed persons should be exempt from compulsory social security contributions in the amount of the statutory minimum.

For the criterion, we propose that those who earn less than € 20,000 throughout 2020 should be eligible for the exemption from payment of minimum social security contributions. Those who earn more will pay back the income tax return.

2. Assist those who have suddenly lost their jobs

Some self-employed people are left without a means of survival and need help.

For the criterion, we suggest: if they earned less than the net minimum wage last month, the state should provide them with assistance in the form of coverage of this difference.

Wishing you all, both the government and the healthcare system and society, to successfully tackle the threat of danger, and to bring people together in support, compassion and cooperation, we welcome you.

Again, you can add you name here

STA, 13 March 2020 - The energy group Petrol last year generated sales revenues of EUR 4.4 billion, which is 1% more than in 2018, while net profit was up by 15% to EUR 105.2 million, the parent company said in a press release on Friday as it presented the annual report.

The group last year posted EUR 472.9 million in adjusted gross profit, up 7% year-on-year, while earnings before interest, taxes, depreciation and amortisation (EBITDA) increased by 9% to EUR 196.5 million.

The net debt-to-EBITDA ratio at the end of 2019 was 1.8, up from 1.7 at the end of 2018.

It sold 3.7 million tonnes of petroleum products in 2019, 6% more than in 2018, at a total of 509 of its service stations.

The group operated 318 stations in Slovenia, 110 in Croatia, 42 in Bosnia-Herzegovina, 14 in Serbia, 14 in Montenegro and 11 in Kosovo at the end of last year.

The group also sold 21.5 TWh of natural gas, 176,400 tonnes of liquefied petroleum gas, 22.6 TWh of electricity and 145.8 thousand MWh of heating energy. No comparisons with 2018 were provided.

Revenues from sales of merchandise and related services meanwhile amounted to EUR 466.5 million in 2019, on a par with 2018.

The report notes that 13% of EBITDA last year was generated with energy and environmental solutions, with the "production of electricity from renewable sources gaining in importance".

The plan for this year is to EUR 6.4 billion in sales revenue, EUR 510 million in adjusted gross profit, EUR 214.8 million in EBITDA, EUR 109.8 million in net profit, and the net debt-to-EBITDA ratio at 1.7.

Sales of petroleum products in 2020 are expected to amount to EUR 3.4 million tonnes and sales of merchandise and related services at EUR 467.6 million.

The current strategy is valid for until 2022, but the new management, appointed earlier this year, has announced that a new strategy until 2025 will be drafted by the summer.

As for the coronavirus outbreak, Petrol said that "there have been no disruptions to our operations so far", adding that "action plans are in place to ensure energy product supply should the situation deteriorate."

The annual report was discussed by the supervisory board on Thursday. "In 2019 the Petrol group performed very well, exceeding the set targets," the board said in today's press release.

STA, 11 March 2020 - Slovenia exported EUR 3 billion worth of goods in January while it imported EUR 2.8 billion. Exports were up 10.6% and imports 5.2% in year-on-year comparison, the Statistics Office said on Wednesday. The export/import ratio was 107.5%.

A surplus in external trade was recorded year-on-year for January for the seventh consecutive time and it now reached the highest January level with EUR 207.4 million.

Slovenia recorded a slight drop in external trade with EU countries, as exports to these countries decreased by 0.8% and imports from them by 2.2% compared to January 2019.

The value of exported goods reached EUR 2 billion and of imported goods EUR 1.9 billion. Slovenia generated 68% of exports and 68.9% of imports in trade with EU countries.

Meanwhile, both exports and imports with non-EU countries were up, by 46.4% to EUR 954.5 million and by 26.5% to EUR 862.6 million, respectively.

The country generated a surplus of EUR 91.9 million in trade with non-EU countries, mostly on account of a rise in trade with Switzerland.

For quite a while, trade in pharmaceutical products with Switzerland has been on the rise since the Swiss pharma giant Novartis opened a logistics and distribution hub at Ljubljana airport serving this part of Europe.

You can see more of this data on SURS

STA, 10 March 2020 - The Constitutional Court has stayed the implementation of an act providing easier access to recourse for roughly 100,000 investors who lost their investments during the banking sector bailout of 2013. The court announced this on Tuesday, two months after the central bank challenged the legislation.

Banka Slovenije said in January that "the most controversial parts of the law affect monetary financing and the financial independence of the central bank".

The act makes Banka Slovenije financially liable for lawsuits from wiped-out investors and mandates it to set aside reserves for damage payments that most estimates suggest could approach a billion euro.

While the legislation is stayed, limitation periods have also been suspended for damage claims as set down in the banking act and for the filing of lawsuits, the Constitutional Court said.

Moreover, Banka Slovenije and the Maribor District Court must remove from their websites posts required by the law on judicial protection procedure for former holders of eligible liabilities of banks.

The data room manager, the Maribor District Court and the Securities Market Agency must suspend all data processing except data storage and must also prevent access to the data.

The Constitutional Court also ordered suspension of all civil law procedures filed under this law and said in the press release that the decision to stay the legislation was unanimous and that the case was a priority.

The court said it decided to stay the act in its entirety because its provisions were very closely interlinked. Constitutional Court judges believe there could be a number of hard-to-mitigate consequences.

Among other things the documents in the virtual reading room could be confidential or contain business secrets, whereas the act allows access to a potentially large group of people.

Some hard-to-mitigate consequences could be related to efforts and expenses of clients and with organisational issues of the Maribor District Court, the only competent court for these cases.

Meanwhile, the Finance Ministry said that it was still examining the decision of the Constitutional Court, while the central bank reiterated its case in a statement.

The Association of Small Shareholders again urged the government and the National Assembly to reconsider a compensation scheme or out-of-court settlements. The compensations scheme would resolve immediately resolve the problems of most small shareholders.

The law on judicial protection procedure for former holders of eligible liabilities of banks was passed in late-2019 after the Constitutional Court said in 2016 that a provision of the law on banking did not give the subordinated creditors and shareholders effective access to recourse.

The 2013 bail-in was managed by Banka Slovenije in conjunction with the government, the European Commission and the European Central Bank (ECB). It resulted in the erasure of roughly EUR 600 million of subordinated bank bonds and shares in several banks held by roughly 100,000 shareholders, which had by then been almost worthless.

STA, 9 March 2020 - The benchmark index on the Ljubljana Stock Exchange suffered the sharpest decline since the early stages of the financial crisis on Monday, moving in lockstep with global markets spooked by the potential impact of the global spread of coronavirus on economies around the world.

The SBI Top lost 7.28% to 817.92 points, the third sharpest decline since its introduction in 2006 and the biggest daily loss since October 2008, as the sell-off affected all blue chips regardless of industry.

Drug maker Krka and insurer Zavarovalnica Triglav were the hardest hit, the former losing 9.2% to EUR 63 and the latter down 9.4% to EUR 29. Another insurer, Sava, was down 7.3% to EUR 17.80.

Telekom Slovenije and port operator Luka Koper also lost in excess of 7%.

The only major issue to lose less than 5% was energy group Petrol, which was down 3.7% to EUR 340.

Turnover approached EUR 6 million, several times the normal daily volume.

With the market now being cheaper, perhaps you’d like to learn more about the SBI Top and the companies it includes – you can do that here

STA, 7 March 2020 - Detection of business opportunities by individuals in Slovenia has been improving in recent years, shows the latest Global Entrepreneurship Monitor (GEM) survey. More than half of Slovenians perceived business opportunities last year, which compares to 38% in 2016, the Maribor Faculty of Economics and Business has announced.

Asked whether they personally had the skills and knowledge to start a new business, 57.5% of the surveyed Slovenians answered affirmatively, which places Slovenia 26th among the 50 surveyed countries around the world.

More than 60% of Slovenians said they knew someone who had started a new business, which ranks the country 14th, while the country is 30th in terms of the share of those who think there are good opportunities to start a business in their area (47.6%).

Almost 55% think that it is easy to start a business (21st), 42.2% have fear of failure (27th), while 15% have entrepreneurial intentions (29%), shows the GEM 2019/2020 global report.

Total early-stage entrepreneurial activity rate in Slovenia is at 7.8%, up from 6.4% in 2018, putting Slovenia in 40th place globally, and in 15th place among the 21 surveyed European countries.

Miroslav Rebernik, the head of the GEM survey team in Slovenia, said that the results showed that creating more profit was by no means the only driver of entrepreneurial activity of the new generations.

"The conscious shift towards more sustainable entrepreneurship is getting stronger, although the desire for creating higher profit still remains a strong motivator," he added.

On a scale from zero (insufficient status) to 10 (very adequate), Slovenia fared the best in physical infrastructure (7.06), while also doing well in internal market dynamics (5.36) and government entrepreneurship programmes (5.13).

"The mark for government entrepreneurship programmes increased the most on average for a second year in a row," noted team member Katja Crnogaj.

The most positive features of Slovenia's business environment include government programmes for small and medium-sized companies intended for the earliest phases of entrepreneurial activity, and the good support environment for start-ups, she added.

Overall, the survey suggests that the conditions which should be developed the most are education at the primary and secondary level, and transfer of research and development to business, which also applies for Slovenia.

The full report can be read in PDF form here, with the section on Slovenia on page 45

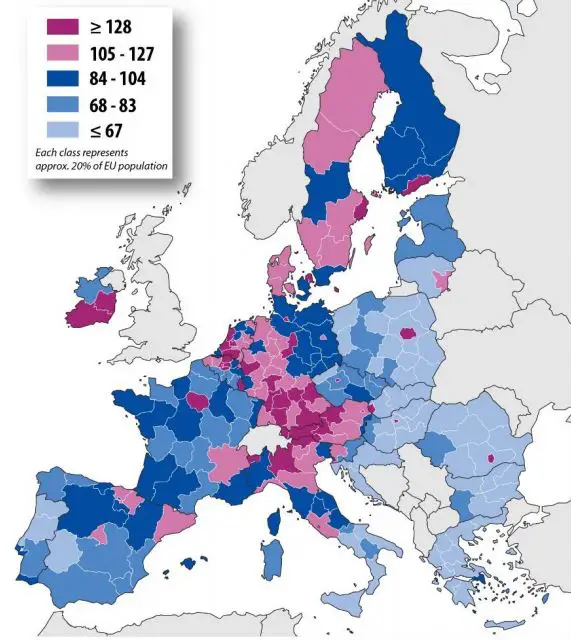

There was considerable interest in yesterday's story on GDP per capita (expressed in PPP terms) in the EU for 2018, which noted the difference between east and west Slovenia, as well as the latter's integration into the area of richer regions stretching north, likely fuelled by the manufacturing might of Germany.

The map from yesterday's story. Source: Eurostat

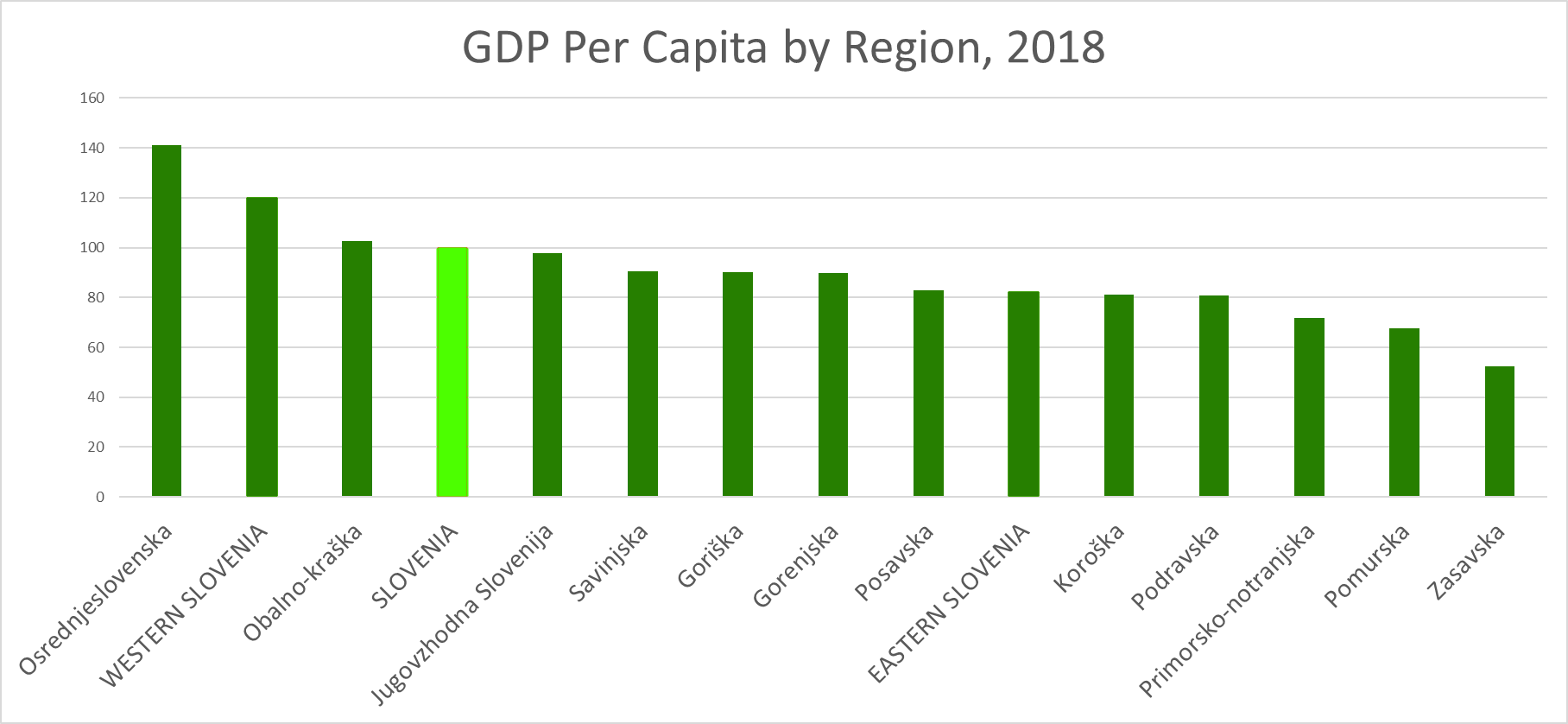

So today we dig a little deeper into the GDP per capita data for Slovenia’s 12 statistical regions in 2018, as released by SURS. The map at the top of the page tells the story, as does the following chart, revealing that Osrednjeslovenska – the centre of the country, with Ljubljana – has 141.1% the average GDP per capita for Slovenia as a whole. The coastal area, Obalno-kraška, is the only other region to be above average, at 102.5%. The poorest region in this regard is Zasavska, with just 52.4% of the average GDP per capita.

If you’d like to dig deeper into the differences between the 12 statistical regions and 212 municipalities, then you can learn how to do so here. If you want to see how Slovenia’s GDP ranked against other formerly communist countries in Europe in the period 1992 to 2017, then you can do that here.