Ljubljana related

STA, 13 August 2020 - Foreign direct investment in Slovenia increased by EUR 552 million in the first half of 2020, a significantly slower rate of increase than in the same period last year, when inbound investment rose by almost EUR 639 million. In the 12 months until the end of June, FDI was up EUR 725.7 million.

According to data released by Banka Slovenije on Thursday, EUR 370.7 million of the increase in the first half of 2020 was accounted for by reinvested profit, EUR 116.7 million by an increase in debt instruments and EUR 64.5 million by equity.

Domestic direct investment abroad meanwhile rose by EUR 222.7 million in the first six months, after it was up EUR 67.4 million in the same period last year. The net decrease in direct investment in the first six months was thus EUR 329.2 million.

Gross foreign debt stood at EUR 48.1 billion in June, a EUR 4.4 billion increase on a year ago. Debt increased the most for the state, by EUR 3.7 billion, and the central bank, by EUR 1.3 billion, while other sectors reduced debt by EUR 0.9 billion.

Net foreign debt amounted to EUR 300 million, a EUR 2.3 billion decrease, the state being the only net debtor in June with a debt of EUR 19.1 billion.

The current account surplus stood at EUR 1.4 billion in the first six months, down EUR 106 million on the same period last year.

The surplus in the trade of goods increased by EUR 236 million to EUR 1.085 billion. Exports decreased by 13.5% and imports by 15.7%. The surplus in the trade of services was down by EUR 400 million to EUR 933 million - the central bank attributes this to issues with travel due to the coronacrisis.

Related- Slovenia in Your Pocket: Coins that Celebrate the Culture

STA, 8 June 2020 - Slovenia's central bank forecasts that Slovenia's economy will contract by 6.5% this year before it bounces back to 4.9% growth in 2021 and 3.6% in 2022. This is however the baseline forecast, there are also two alternative scenarios that factor in the gravity of the coronavirus crisis.

Under the positive scenario, the economy would contract by just 4% this year and expand by over 7% in the next two years; under the negative scenario the economy would contract by 10% this year, followed by stagnation in 2021 and a slow recovery in 2022.

Vice-governor Jožef Bradeško said the baseline scenarios accounted for less stringent lockdown measures and assumed the crisis will last through the first half of next year, when a medical solution is expected.

Under this scenario, "the positive effects outweigh the negative effects of harsher restrictive measures and the relatively high share of tourism," he said.

The baseline scenario assumes that private consumption will contract by 6.6% this year, which will be partially offset by a 3.5% increase in public spending.

Private consumption is expected to pick up next year, but government spending is projected to climb down.

Banka Slovenije's head analyst Arjana Brezigar Masten said domestic fiscal policy measures were an important component of the forecast since they offset the decline in private spending.

Absent stimulus measures, GDP would decline by a further three percentage points, she said.

Investments are expected to contract sharply this year, by 14.4%. Exports of goods and services are to decline by nearly 12.6% and imports by 13.6%.

A robust recovery of exports and imports is projected for 2021 and 2022, but it is thought domestic spending will be the main engine of growth going forward.

Employment is forecast to contract by almost 2%, which will lead to an increase in the average survey unemployment rate to 6% from 4.5% last year.

Inflation is expected to drop to zero this year before rising to over 1% in the next two years.

Consumer prices will be held down by low oil prices, which will offset the projected increase in food prices. Additionally, prices will be weighed down by poorer demand and external deflation pressure.

During the forecast period Slovenia will initially see a deterioration of public finances, with the general government deficit expected to exceed 8% of GDP this year.

The central bank believes the fiscal position will improve given that the shock will be only temporary, but general government debt will remain relatively high.

Central bank analysts estimate the existing stimulus measures at 5% of GDP.

Janša Welcomes German-French Proposal for €500bn Fund to Restart EU Economy, Calls for More Ambition

STA, 19 May 2020 - PM Janez Janša has welcomed a German-French proposal for the EU to set up a 500 billion euro fund to restart the economy after the Covid-19 pandemic. However, he believes an even more ambitious approach would be needed to address a crisis of such proportions. He also discussed it with his Italian and Austrians counterparts.

Germany and France proposed on Monday that EUR 500 billion be raised in public markets to fund, through grants, the EU sectors and regions where the impact of the coronavirus has been most star stark.

"It is a good step forward. 500 billion euro is indeed macroeconomically relevant number, but more ambitious approach would be welcome for this scale of a symmetric crisis.

"Now we need a swift agreement on the multi-year financial framework and a recovery fund as a package," Janša said in response to European Commission President Ursula von der Leyen's welcoming the German-French idea.

Janša also announced on Twitter that he had discussed the proposed relief fund and the EU's multi-year budget with the Italian and Austrian prime ministers, Giuseppe Conte and Sebastian Kurz.

PV @JJansaSDS je ???? predlog o 500 milijard evrov vrednem skladu za zagon gospodarstva EU po #COVID19 ocenil kot "dober korak naprej." Sklad bi se financiral z zadolževanjem v imenu EU, z njim pa bi financirali najbolj prizadete sektorje in regije.https://t.co/63drgkx2VP pic.twitter.com/I1daOe3lgd

— Vlada Republike Slovenije (@vladaRS) May 19, 2020

"We agreed that in order to overcome the crisis and help companies and families, we need an ambition proposal by the European Commission.

"This is of vital importance for the EU and the common market to fully recover," the Slovenian prime minister tweeted after speaking with Conte.

Earlier in the day, Conte also took to Twitter saying the German-French proposal was an important step in the direction Italy had proposed.

The talk with Chancellor Kurz also focussed on "border opening and experiences from the fight with the coronavirus, where Slovenia and Austria are among the most successful countries", Janša tweeted.

However Kurz does not seem to be eager to relax border checks on the border with Slovenia, which is part of the EU's internal borders, while Austria, the Czech Republic and Slovakia agreed earlier today that they would reopen their borders in mid-June.

Kurz is also reserved about the idea for a 500 billion euro fund, announcing that Austria would come up with a counter-proposal with another three countries (Netherlands, Denmark and Sweden) for a fund based not on grants but on loans.

Janša had meanwhile promoted the idea of coronabonds with which the EU as a whole would finance the ramifications of the pandemic.

STA, 23 March 2020 - Virtually all Slovenian businesses have been affected by the coronavirus pandemic and its ramifications with 93% of the companies surveyed by the Chamber of Commerce and Industry (GZS) reporting serious difficulties. The chamber estimates a stimulus package of up to 4 billion euro is needed to avert an economic and social crisis.

"The situation at businesses is getting more alarming by the day," the GZS stated on Monday as it released the results of a survey conducted last week among micro, small, medium-sized and large companies.

Four out of ten companies estimate their revenue will drop by more than 70% in March due to disruption to business caused by coronavirus, a further 18% expect to halve their revenue and as many project a fall of at least 30%.

Micro and small businesses have been particularly hard hit with half of them expecting more than a 70% fall in revenue.

Current estimates show more than half of the companies surveyed expect a slump in business over the next three to six months and one out of three expect a limited scope of operations to persist for more than six months.

A large majority (61%) have been hit hardest by a drop in domestic demand and government measures banning direct sale of goods and services to customers, suspended public transportation and school closure (59%).

Over a third (37%) report difficulties due to lockdowns and similar restrictions in other countries, and almost as many (35%) say they have been affected by a drop in foreign demand.

Other problems reported by the companies surveyed include disruption to international transport (29%) or disrupted supply chains (20%). Some are complaining about a lack of protective equipment.

"Fact is that we have already moved from a health crisis deeply into an economic crisis. Experience suggests that a health crisis takes about two and a half months. In a similar scenario in Slovenia the epidemic jeopardising people's lives could be weathered by roughly mid-May," the chamber said.

It added that the decisions that were being taken by the government these days would decide how deep and how long the economic crisis, and hence the scope and length of social turmoil.

Businesses expect the state to fully cover the cost of the temporarily laid off labour force, defer tax liabilities, take measures to secure liquidity and labour market flexibility, set up a one-stop shop offering topical info for companies, ensure smooth movement of goods across the border and measures to secure claims in some markets.

The GZS estimates that for the Slovenian economy to remain in business and preserve as many jobs as possible liquidity measures of between two and four billion euro are needed, urging the government to draw up a new emergency package.

The chamber has sent its list of proposals to the Ministry of Economic Development and Technology.

The GZS has also joined a group of several other business associations, including the Slovenian-German Chamber of Commerce, the British-Slovenian Chamber of Commerce and AmCham Slovenia, who called for fast action to help businesses.

The group offered to the government and the crisis busting taskforce headed by economist Matej Lahovnik "all the expertise that Slovenian managers, entrepreneurs and economic and management experts can offer".

The calls come as a growing number of business are suspending or scaling down their operations to the minimum. The latest to announce a temporary closure of its 18 shops across the country has been the Croatian bakery chain Mlinar.

The glassworks Steklarna Rogaška reduced its production to 7% capacity because it cannot halt the melting furnace without long-term consequences. The decision was taken in agreement with its owner, the Helsinki-based Fiskars Group, the trade union and the works council.

The Zreče-based tool maker Unior has reduced production as well, but is still meeting its obligations to buyers, and business is continuing as usual in the division catering to the automotive industry.

Second emergency package taking shape, hints at help for self-employed

STA, 23 March 2020 - The government will discuss Monday evening guidelines for a new emergency package to mitigate the impact of the coronavirus epidemic on the population and the economy. The guidelines, which include pay bonuses for workers in critical sectors, will be presented on Tuesday and include aid to the self-employed, PM Janez Janša announced.

Janša said the guidelines, to serve as a basis for legislation the government wants to adopt by this Friday, had been coordinated by the coalition parties last Friday and were now supplemented with proposals by ministries and the advisory task force led by economist Matej Lahovnik.

The pending new measures announced last Saturday include 10-200% pay bonuses to those working in critical sectors such as healthcare, civil protection, security and critical infrastructure, as well as a temporary 30% pay cut for all state officials.

Employers in the private sector will be advised to secure bonuses for hard-working staff, in particular in groceries.

In a tweet published today, Janša added the "guidelines will include solutions for aid to the self-employed", a measure that many argued was lacking in the first emergency package adopted by parliament last week.

According to Janša, the basic idea of the package will be freezing the state of affairs. Thus the government will secure the funds needed "to preserve jobs, social stability, economic capacity, public service, potential in science, culture...in society in general".

On Saturday Janša announced a crisis bonus for pensioners and other vulnerable groups and compensation for companies that had to close shop because of the epidemic.

The government plans to define a model for determining the damage suffered by businesses as a result of the epidemic and lay down a reimbursement framework.

In the night to Friday last week, parliament passed the first package of emergency laws. The measures included pay compensation for temporary lay-offs, loan payment and tax duty deferrals for companies, as well as trade restrictions for agriculture and food products. One act gave the government complete discretion over the allocation of budget funds.

STA, 5 March 2020 - Slovenia's per capita gross domestic product (GDP) in purchasing power standards reached 87% of the EU average in 2018, which is up two percentage points compared to 2017. GDP per capita is a key criterion for eligibility for EU structural funds.

The Western Slovenia region exceeded the EU average by 5%, while Eastern Slovenia was at 72%, fresh Eurostat data show. This means the country may see an even bigger drop in the amount of cohesion funds it will have available in the bloc's 2021-2027 financial framework.

Having recorded solid economic growth since 2014, Slovenia saw its economy expand by almost 5% in 2017. In 2018 and 2019 growth slowed but was still significantly above the EU average.

The country's performance in GDP per capita relative to the EU average thus improved by two percentage points each in 2016, 2017 and 2018.

The gap between the Western and Eastern Slovenia has meanwhile been deepening. In 2017, Western Slovenia exceeded the EU average by 2%, while Eastern Slovenia reached only 70% of the EU average.

GDP per capita in the whole country totalled EUR 22,100 in 2018 and purchasing power parity (PPS) 26,400.

In Western Slovenia, GDP per capita stood at EUR 26,500 and PPS at 31,600, while in Eastern Slovenia the figures were EUR 18,100 and 21,700, respectively.

The highest GPD per capita in the EU after the UK exited the bloc was recorded in Luxembourg, where it exceeded the EU average by 163%, followed by Southern Ireland (125% above EU average), and Eastern and Midland Ireland (110%).

You can see more of this data, in PDF form, here

STA, 13 February 2020 - The European Commission has kept Slovenia's economic forecast unchanged at 2.7% for 2020 and 2021, more than double the eurozone average. In its winter 2020 forecast released on Thursday, it said consumption and investment are expected to continue growing while net exports are set to "weigh on growth over the forecast horizon".

Net exports are expected to have a positive impact, but their contribution to headline growth will be slightly lower due to lower export demand growth and robust import growth.

Private consumption is expected to remain strong in the next two years provided the employment rate remains high and wages keep on rising.

Investment growth is also forecast to continue apace, albeit at a slightly lower rate than in 2019 due to weaker economic confidence.

The Commission has also said that housing investment is expected to start growing due to recent increases in house prices. Moreover, commercial real estate and public investments are projected to continue increasing as well.

Meanwhile, higher wages will drive up inflation, in particular in the services segment. "Overall, consumer price inflation is forecast at 1.9% in 2020 and 2% in 2021", up from 1.7% in the second half of 2019.

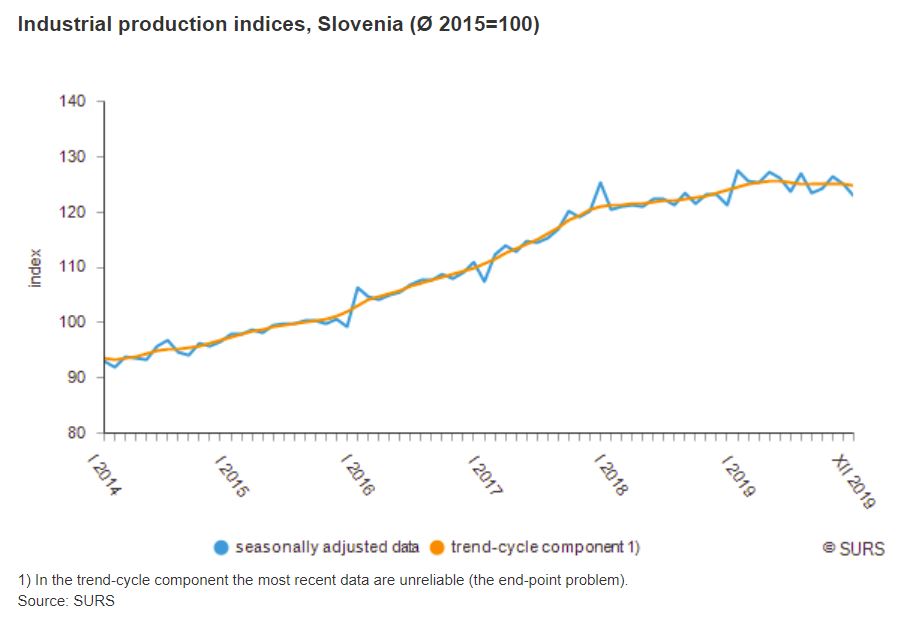

STA, 10 February 2020 - Slovenia's industrial output increased by 3% last year, the sixth consecutive year of growth. The output in December was 1% higher than in the same month a year ago but 1.8% lower than in November.

Fresh data from the Statistics Office show an annual growth in the value of industrial production, stocks and turnover in industry.

The 3% growth rate in industrial output last year is a slowdown compared to the 5% growth rate recorded in 2018 and a six-year high rate of 8.4% in 2017.

The growth was driven by a 3.4% growth in manufacturing, while the electricity, gas, steam and air conditioning supply sector and mining and quarrying contracted by 0.8% and 3.6%, respectively.

Industrial turnover increased by 2.3%, owing to a 3.1% growth in the foreign market and a 1% growth in the domestic market. Sales revenue rose across all main industrial groupings, the most in consumer goods industries, at 4.5%.

In December, industrial turnover was 1.8% lower than in November and 1.5% higher than in December 2018.

The value of stocks rose by 4.1% last year. In December their value fell by 0.5% compared to the month before but rose by 2.9% year-on-year.

More on the data can be found here

STA, 5 February 2020 - Slovenian executives are quite pessimistic about the prospects for global economic growth this year as more than half think growth will slow down, shows a survey conducted by PricewaterhouseCoopers (PwC).

"The sentiment of this year's survey of Slovenian directors is best summarised with the word uncertainty," head of legal services at PWC Slovenia, Sanja Savič, told the press on Wednesday.

Last year 47% of directors thought that global growth will deteriorate over the next 12 months, this year 53% think so.

The Slovenian figures are very much aligned with global trends. In last year's PwC survey just 29% of directors were pessimistic, this year the share rose to 53%, in what is the biggest jump in pessimism since 2012.

Savič said uncertainty was present across all segments of the economy and is the consequence of "tensions in international trade, political turmoil, increasing protectionism, coronavirus, terrorism, cyberattacks and increased regulation".

The factors most commonly highlighted by Slovenian directors as having an impact on growth of their companies include uncertain economic growth (78%) and higher taxes (76%). Technological change (67%) and availability of skilled staff (60%) also rank high.

Savič pointed out that Slovenian directors do not perceive cyberattacks as a major threat, as they ranked last among perceived threats (49% mentioned them). Globally, however, the share is much higher, 73%.

Slovenian directors plan to employ a variety of strategies to counter the growing uncertainty, foremost among them organic growth, which is the choice of 69% of Slovenian respondents.

"Interestingly, 50% of Slovenian directors said they would forge new strategic partnerships this year. What this means remains to be seen," Savič said.

Several directors were on hand for the presentation and highlighted the business environment as the overarching problem.

"We don't need much, all we need is a stable and predictable business environment," said Dejan Turk, the director of mobile operator A1 Slovenija.

Likewise, Sašo Berger of IT company S&T said high taxes were not a problem, the business environment was.

This is the second time Slovenia was included in the PwC survey, which has been conducted for over two decades. A total of 45 directors took part in Slovenia and almost 1,600 globally.

8 January, 2020 - Slovenia’s declaration of independence on 25 June 1991 came just a few months before the fall of the Berlin Wall in November, and the ensuing collapse of the post-World War 2 order in Europe. While there were many differences between East and West, and many reasons for the break-up of Yugoslavia and end of the Soviet Union, economics undoubtedly played a key role, and living standards a much-watched indicator of the success, or failure, of the transition to a market economy. Although, once again, note that Slovenia (as part of Yugoslavia) was not a member of the USSR, and operated a different, more open and non-aligned form of socialism than that seen behind the Iron Curtain.

Still, how have the various economies of post-communist Eastern and Central Europe fared in the three decades since opening to the world? One way to look at this is with the following video, which shows the GDP per capita from 1992 to 2017 for the top 10 nations included in the data. The GDP is presented in US dollars and Purchasing Power Parity (PPP) terms, a measure that considers the crude income compared to the prices of goods in the different countries. As such, it’s seen as a good measure of relative affluence, and for comparing the economic productivity and standards of living between different nations

It’s best and most fun to just watch the video, and see how nations rise and fall over time, but in summary: Slovenia starts at #2, slightly behind the Czech Republic (aka Czechia) in 1992. These two then stay at the top, very close together, until 1998, when Slovenia takes pole position. After this, Slovenia pulls ahead, soon maintaining a lead of some US$2,000 until 2007, when Czechia closes the gap, then takes over the top spot in 2009. Slovenian then regains #1 for 2010 and 2011, but after that Czechia is in the lead.

Another way to look at this data is to zoom out and put Slovenia among the all the other EU Member States, with the country having joined the organisation in 2004. It’s on watching this you may have some questions about Luxembourg, with a population just under a third that of Slovenia.

Note that the first the video was produced by Lionwork Statistics, and was released with the following notes:

- There was no data available for Slovenia, Croatia, Latvia, Lithuania, and Estonia until 1995. In these cases, the average growth rate of the nearest region was used to calculate the estimated value. In the case of Estonia, data are shown from 1993, since no similar region is present due to geographical placement.

- The comparison includes Albania, North Macedonia, Montenegro, Serbia, Bosnia and Herzegovina Slovenia, Lithuania, Latvia, Estonia, Hungary, Slovakia, Czech Republic, Poland, Croatia, Bulgaria, Romania, Moldova, Belarus, Russia, and Ukraine. Some never made it to the Top 10 during the time period.

STA, 4 December 2019 - Economist Velimir Bole has assessed that the Slovenian economy is much more resistant to new shocks than it was before the last economic crisis, but that the price for that is a somewhat lower growth. On the other hand, challenges remain when it comes to competitiveness related to a development breakthrough.

At Wednesday's presentation of Outlook 2020, a publication released by the Manager Association, Bole noted that companies and financial institutions had reduced their debt significantly. Households remain among the least indebted in Europe, and the state is under the eurozone average despite a high debt growth.

Overall, Slovenia is almost three times less indebted than the eurozone on average and is less indebted than the economic superpower Germany, he added at the event at the Ljubljana Faculty of Economics, hosted by the newspaper Delo.

According to Bole, indicators in public finances, balance of payments and price competitiveness have improved after the crisis significantly more than in the eurozone as a whole. Macroeconomic stability is much higher than before the crisis and is approximately at the level of Germany.

The resistance of the economy is thus significantly higher, but this does not come without opportunity costs, he said, adding that two of these were slower growth and a higher saving rate.

If there is no major global shock, which cannot be excluded, Bole believes that growth could accelerate again in the third quarter of next year, but one of the main questions is to what extent domestic consumption will be reduced in 2020 due to the slow-down in the manufacturing sector.

Arturo Bris, the director of the International Institute for Management Development (IMD), meanwhile said that despite the higher resistance of the Slovenian economy to a potential crisis, there were challenges regarding competitiveness.

The Lausanne-based institute manages an internationally-recognised economic competitiveness list, on which Slovenia places 37th in overall competitiveness, 32nd in digital competitiveness and 31st in terms of talent.

Bris pointed to what he believes are Slovenia's two major problems - the (in)ability to attract foreign direct investments, with the reason being unfavourable tax policy, and the rigid and restrictive regulation.

Slovenia's rating in both factors is very low, while it is very high in terms of social cohesion and security, he added.

While Slovenia is in a very good position in terms of digital competitiveness, there are two weaknesses - inadequate regulation for development of digital economy and companies not being as ready to introduce technological novelties as citizens.

When it comes to the availability of qualified workforce, Slovenia's problems are the inability to attract foreign talent despite good conditions and high quality of life, and educated and talented young people leaving the country.

According to Bris, the problem in Slovenia is not the framework for competitiveness or fairness of the system, but inefficiencies in the system. One of the problems is businesses distrusting the state, he said, adding that businesses should cooperate with the public sector, as this was the only way for major changes.

He admitted that the observations of Slovenian business executives participating in IMD surveys did not necessarily always reflect the reality. This is a problem and this gap needs to be closed, otherwise the country's reputation will be worse than it actually should be, he added.