Business

STA, 12 March 2019 - Exports by Slovenian companies amounted to EUR 2.7bn in January, which is 13.7% more than in the same month in 2017, while imports stood at EUR 2.6bn, a 8.7% year-on-year increase, the Statistics Office (Statistični urad Republike Slovenije, SURS) reported on Tuesday.

The trade surplus amounted to EUR 120.9m, the highest January surplus on record. The exports-to-imports ratio was 104.7%.

Slovenia's exports to EU member states amounted to EUR 2.05bn, up 8% year-on-year, while exports from the EU rose by 3.3% to EUR 1.91bn.

Surplus in trade with the EU countries was at EUR 140.1m, or one-third more than in January 2017. Exports to the EU represented 75.6% of total exports and imports represented 73.7% of total exports.

Exports to non-EU countries surged 36% in January to EUR 660.4m, while imports from outside the bloc increased by 27.2% to EUR 679.6m.

A deficit of EUR 19.2m was thus recorded in trade with non-EU countries, the Statistics Office said.

More details can be found at SURS, while all our stories on business and Slovenia are here

STA, 8 March 2019 - Sava Re, Slovenia's second largest insurance group, generated a record profit of EUR 43m in 2018, an increase of 38.3% on the year before as gross written premiums rose by 5.6% to EUR 546.3m.

The core company Sava Re saw its profit increase by 27% to EUR 41.87m, while gross written premiums decreased by a percent to EUR 151.6m.

Releasing the results on the web site of the Ljubljana Stock Exchange, the company said that 2018 saw a relatively low incidence of large claims, which was reflected in the group's improved performance.

"Profitability was also supported by the synergies from the merger of four insurers now under the unified brand of Zavarovalnica Sava and the better performance of the group's non-EU-based members," the release said.

Chairman Marko Jazbec told the press that 2018 was a "record year and a very successful for the entire group," with both plans for 2018 and results from 2017 having being exceeded.

Jazbec added that the management was especially proud of the record group profit, and the "exceptionally high return on equity, amounting to 13.1%."

The growth in group premium was generated by expansion in non-life insurance business in Slovenia (up 10.9%) and outside it (12.5%) and a 17.8% growth in life insurance business abroad.

The volume of collected gross premiums in the group, which also has subsidiaries in Croatia, Serbia, Montenegro, Kosovo and North Macedonia, last year exceeded the planned by 5.1%.

The reinsurance segment saw 7.2% less in gross written premium as a result of strict underwriting discipline and selective underwriting.

As anticipated, there was a drop of 2.9% in gross life insurance premiums written owing to a large number of policy maturities.

"When it comes to reinsurance on the global market, we were relatively conservative from the aspect of assuming new risks, so we recorded a drop in premium, which is partly also a result of the fluctuation of the US dollar compared to other currencies," said Jazbec.

Operating revenue of the group was up by 9.8% last year, which in addition to the growth of gross premiums by the existing companies was also a result of the operations of the new companies included in the group in 2018.

The group finalised three takeovers last year: the North Macedonia-based pension company NLB Nov Penziski Fond, which was renamed Sava Penzisko Društvo; the Serbia-based insurer Energoprojekt Garant, which was merged with Sava Re's Serbian non-life insurer at the year end; and the Slovenia-based assistance service provider TBS Team 24.

Sava Re has also signed agreements on the acquisition of three further companies; the transaction involving two Croatian ERGO companies was finalised in February and the one involving KBM Infond slated for closing later this year.

Investors on the Ljubljana Stock Exchange have responded to the record results, with the Sava Re share adding 2.35% to EUR 17.40 around noon.

The dividend proposal from the management and supervisory boards will be known in April, when the AGM will be called.

Jazbec said that "dividends will certainly not be lower than last year," when Sava Re paid out a total of EUR 12.4m in dividends to its shareholders, or 80 cents per share.

Regarding the plans for 2019, Jazbec reiterated that net profit was expected to increase by another 10%, while collected premiums were planned to exceed EUR 555m.

You can find all our stories about business in Slovenia here

STA, 8 March - Young Slovenian businessman Damian Merlak, who has made more than 100 million euro with last year's sale of Bitstamp, one of the world's largest crypto currency exchanges, has bought four run-down hotels in the Alpine valley of Bohinj, north-western Slovenia, for 8.4 million euro.

Merlak bought Zlatorog Hotel, Bohinj Hotel, Bohinj Apartment Hotel and Ski Hotel Vogel, at excellent locations near Lake Bohinj, from businessman Zmago Pačnik and his family, news portal Siol reported on Friday.

While it did not report how much Merlak paid for them, business newspaper Finance said the deal, involving the purchase of three firms managing the hotels, was worth 8.4 million euro.

Back in 2016, the Pačniks wanted to sell them for 15 million euro, putting the highest price tag of seven million euro on Zlatorog Hotel, which needs the most repairs.

Merlak told the STA he had bought the hotels to renovate and re-launch them. The ones being leased will continue to operate in the same way, while the rest will be managed by his team after renovation.

He also noted the 43-room Zlatorog Hotel, located above the lake and closed since 2011, would be the most demanding project.

It is not only in an extremely poor condition, having been stripped bare over the past few years, "but also unsuitable for 2019 in terms of design", he added.

The value of its renovation will depend on which of the variants architects are working on is chosen, but "I'd be very happy if Zlatorog is ready for use in two years' time".

Bohinj Hotel, situated by the lake, has 20 rooms and 34 suites. Bohinj Apartment Hotel with 27 self-catering units is said to be in a state similar to Zlatorog's.

The 28-room Ski Hotel Vogel is located some 50 metres from the ski slopes on Mount Vogel above the lake.

According to Siol, the hotels used to be managed by the Alpinum company, which the state sold cheap to the Pačnik family in 2002.

The Pačniks had been leasing them and invested practically nothing into them, so the Bohinj municipality had urged the state to take measures to save them from ruin.

For Merlak, the hotels are not his first investment in Bohinj. In 2016 he bought the Tuba self-catering units near the well-known Savica waterfall.

Even before that, he and his former Bitstamp partner Nejc Kodrič bought several farms with 1,300 cattle. He also bought a veterinary clinic.

All out stories on blockchain and Slovenia are here

https://www.total-slovenia-news.com/tag/blockchain

PM Surprised By Hunt Lobbying for UK Fracking Company: “In Slovenia We Operate in Line with the Law”

STA, 8 March 2019 - Prime Minister Marjan Šarec told the weekly Mladina that UK Foreign Secretary Jeremy Hunt had raised the issue of a UK company's gas extraction project in the north-east of Slovenia during their talks in Ljubljana at the end of February. Šarec said he found the manner of inquiry unusual.

The fracking attempts in the Petišovci area were stopped by former Environment Minister Jure Leben after UK company Ascent Resources had been pressuring the country to issue an environmental permit and even threatening with a lawsuit before an EU court.

Several environmental NGOs and parties had also accused UK Ambassador Sophie Honey of lobbying and putting pressure on Slovenian authorities to secure the permit for fracking.

Šarec said in an interview with Mladina that the case had come up in the talks with Hunt in Ljubljana on 21 February.

Asked whether Hunt had lobbied during the talks, Šarec replied in the affirmative. "Yes, his questions regarding this case were, I must say, unusual.

"I believe that such talks do not become a foreign secretary, because it makes the whole thing resemble horse-trading."

Šarec said he had told Hunt that "in Slovenia we operate in line with the law."

"I'd like to point out that the permit for fracking is not a matter of a favourable political stance toward this or other party but a matter of legislation.

"I am also personally convinced that these procedures for extracting oil or gas undoubtedly entail certain environmental risks."

Šarec also noted that lobbying was usually reported to the Commission for Corruption Prevention but it this case this was not necessary, because he had publicly spoken about it now.

All our stories about fracking in Slovenia can be found here, while all our stories about Jeremy Hunt are here

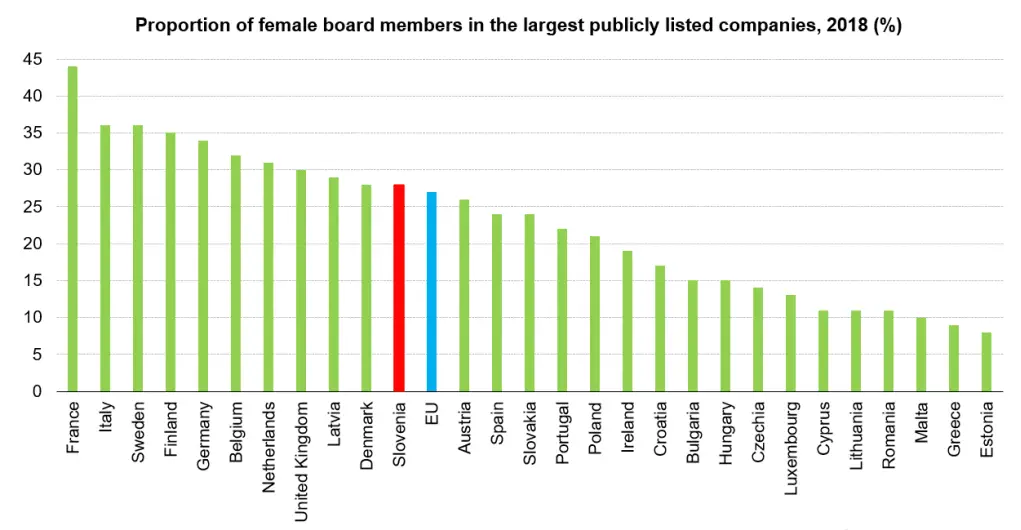

STA, 8 March 2019 - Slovenia ranks high among EU member states in terms of the proportion of women in senior management positions. However, even as the rate is increasing, it is still far below targets set a few years ago.

Data released by Eurostat ahead of International Women's Day indicate that almost half of managerial positions in Slovenia are filled by women (47%) and one in four senior executives is female.

This places Slovenia fifth among EU member states, with EU average at 36% and 17%, respectively. The data take into account positions in public and private sectors.

While still above EU average, Slovenia is not among the leaders when it comes to the percentage of women on board members of publicly listed companies, which is at 27%, only a percentage point above EU average.

Similarly, data from the European Institute for Gender Equality show that the proportion of women in senior positions in largest listed companies in Slovenia is increasing.

The proportion of women CEOs, executives and non-executives in such companies rose to 24.7% in 2018, the highest in recent years.

Commenting on the figures, the Manager Association said that this was still far from the target of 40% by 2020, set in a EU directive proposal in 2013 by the then Justice Commissioner Viviane Reding.

The association has been advocating legislative changes to improve gender equality in top corporate positions, pointing to surveys showing companies with gender-balanced managements perform better.

This is also evident from the the Women in Work Index, a survey conducted by Pricewaterhousecoopers, where Slovenia gained one spot to place 4th among the 33 OECD countries.

Consultancy Bisnode has surveyed 18,300 businesses whose chief executives are women, finding that while those represented 25% of the economy, they generated 37% of total revenue and 39% of total profit in 2017, employing 37% of the workforce.

The analysis also showed above-average efficiency of "women businesses", having turned one euro into almost 1.3 euro of profit, which compares to the overall average of 0.9 euro.

Melania Seier Larsen, executive director of Boston Consulting Group and vice-president of the women manager section at the Manager Association, noted disparity between women university graduates and those in senior positions.

"Women represent as much as 58% of graduates, but then there are only 20% women executive directors and only 5% of women are chief executives," she said.

Trends in science are similar; while about as many women as men graduate or even win a PhD degree, the proportion of women as they pursue their careers to regular professorship drops to 17%.

Larsen noted that gender inequality in decision-making positions was huge, quoting World Economic Forum in projecting that at the current pace it would take 100 years to close the gender gap.

The full report, in PDF form, can be found here

STA, 7 March 2019 - Slovenian banks recorded a cumulative net profit of just over EUR 496m in 2018, the highest since the pre-crisis year 2007 and an increase of almost 17% over the year before on the back of robust growth of non-interest revenue.

Whereas net interest revenue rose by just 3% to EUR 672m due to persistently low interest rates, non-interest revenue surged by over 14% to EUR 482m, shows a central bank report released on Thursday.

The figure confirms earlier findings that banks have been increasing service fees to offset low interest rates.

The sector also profited from the cancellation of provisions for non-performing loans, though that contributed only EUR 48m to the bottom line, a tenth more than in the year before.

Operating costs increased only marginally, by 0.6% to EUR 700m.

Total assets increased by 2.2% to EUR 38.78bn, in what is the second consecutive annual increase.

Non-banking deposits were up 5.3% to almost EUR 30bn, mostly due to a EUR 1.2bn increase in household deposits.

Loans to the non-banking sector grew at a rate of 3.3% on the back of robust lending to households, which now account for a quarter of total outstanding loans.

Asset quality improved last year as banks reduced exposure to non-performing loans to 4% from 6% measured by the broad definition of the European Banking Authority.

Despite the rapid improvement, the share of non-performing loans to the corporate sector remains high, at 8.4%. This is however a 4.5-point improvement on the year before.

All our stories about Slovenia and banks can be found here

STA, 6 March 2019 - The Chamber of Commerce and Industry (Gospodarska zbornica Slovenije - GZS) has proposed a reform of the pay system in the corporate sector for 2019-2025 centred around tying wage growth to productivity gains, echoing its long-standing position that pay should be more performance-based.

https://eng.gzs.si/

Under the proposal unveiled on Wednesday, average gross wages would increase by nearly a quarter by 2025, provided that annual productivity gains almost doubled compared to 2014-2018, from 2.7% to 4.8%.

The goal of the proposal is to increase value added per employee to EUR 60,000 and exports to EUR 50bn. In that case, the average gross wage would be EUR 2,000, GZS director general Sonja Šmuc said.

Slovenia's exports amounted to EUR 31bn last year, the average private sector gross wage was at EUR 1,647 in December, whereas value added per employee was EUR 43,000 in 2017, the latest year for which data are available.

"Assuming appropriate productivity gains, the average gross wage could rise by EUR 370," GZS chief economist Bojan Ivanc said.

Related: Find out the average pay for various jobs in Slovenia

To achieve the required productivity gains, Slovenia has to step up investments in research and development and improve vocational education, according to Šmuc.

At the same time, wages in the public sector must grow at a slower pace than private sector pay, and the retirement age must gradually converge towards the EU average.

"It is time to talk about this now, not when we already have major problems funding pension," Ivanc pointed out.

The GZS has sent its proposal to all social partners and will now try to reach a consensus. Negotiations are expected to start next week.

Meanwhile, employers and trade unions have voiced reservations about the proposal. An exception is the ZSSS, Slovenia's biggest trade union confederation, which believes the goals could be reached.

Marjan Trobiš, the head of the Employers' Association, expressed surprise that the proposal was presented as having the backing of the entire business sector.

He said that his association had only gotten the text yesterday and had not yet had the chance to become fully acquainted with the document. He is also surprised that negotiations are to start as early as next week.

Igor Antauer, the secretary general of the Trade Crafts and Small Business Employers' Association, said that the proposal had not yet been coordinated among employers.

"It's a shame that somebody was in a hurry ... and that they did not check what would happen to all segments of the private sector not just the industries represented by the GZS."

Pergam trade union head Jakob Počivalšek said that the document was not aiming to raise salaries but to limit them and enable higher pay for managers.

Počivalšek said he was not against investing in R&D and training, but that the proposal provided no guarantees that this would actually be the case and the funds would not be spent on higher pay for top managers.

Lidija Jerkič, the head of the ZSSS, is not as critical. "These goals are nothing new. They can be reached but will require a restructuring of the industrial sector." She added that it was high time to reach an agreement on private sector pay.

STA, 6 March 2019 - Mercator needs to be excluded from the indebted Agrokor group and transferred to the new Fortenova Grupa as soon as possible, Agrokor's crisis manager Fabris Peruško has told the STA in an interview. The process has its own dynamics, he said, adding that it could be completed by the end of the year.

Peruško has been responsible for the winding down of Agrokor since February 2018, he will also head the new Fortenova Grupa which will be launched on 1 April to bring under one hat Agrokor's successful subsidiaries.

Meanwhile, the insolvent companies will remain part of Agrokor. The process of transformation will start with Agrokor's companies in Croatia, while those based in other countries will be included once the process is completed in Croatia.

On 1 April, 32 solvent Croatian companies will become part of the new group, while the 45 Croatia-based insolvent companies, which will remain part of Agrokor, will each get their own "mirror company", which will also be included in the Fortenova Grupa.

The names of the new companies will be made up using their original names and the word plus, said Peruško.

The third group of companies includes Croatia-based companies in which Agrokor holds less than 25% and 82 Agrokor companies based in Slovenia, Serbia and Bosnia-Herzegovina.

"Mercator is in the third group and we want a speedy transfer of assets from the company in receivership, Agrokor, to the more health company, Fortenova. This is also important for Mercator's suppliers, employees and the entire Slovenian economy."

Peruško expressed satisfaction with "fair relations" between Agrokor and Slovenia's Economic Development and Technology Minister Zdravko Počivalšek, as well as with Gregor Planteu, a government-appointed member of Mercator's board.

He believes that it would be advantageous if Planteu remained on the board of Mercator also after the retailer becomes a part of Fortenova Grupa. The transfer of Mercator to Fortenova does have its own dynamics which depends on the Slovenian legislation.

"Certain small Slovenian banks have reservations about the transfer but I believe that the plan contains rational economic arguments and that it must be green-lit as soon as possible because this is in the interest of the banks."

"If the banks fail to support the transfer, Mercator will remain a part of a company that has gone bankrupt. This is in nobody's interest," Peruško said when asked about the potential scenarios for Mercator's future.

The most imminent steps for the plan to be implemented is to get the go-ahead of the Slovenian competition watchdog and resolve issues involving minority shareholders, both of which Peruško sees as mere formalities, which do, however, take a certain amount of time.

When asked whether Mercator could become one of the leading companies of Fortenova Grupa, Peruško said that Mercator, as well as Croatian retailer Konzum, must be viewed in the scope of the group's entire retail division.

Both companies are facing challenges in different markets of the region. Their operations must be optimised to the benefit of the entire group. Peruško underlined that synergies of the two groups must finally become reality.

Peruško, who was not involved in Agrokor's takeover of Mercator in 2014, believes that the Croatian group paid a lot for Mercator. He also said that Mercator was in better condition now than it was before the takeover.

"When it was taken over by overindebted Agrokor, Mercator was not a healthy company and Agrokor provided a much-needed injection that helped it survive."

"The problems started when they failed to build a platform that would make them healthy partners for their suppliers." Peruško said that Fortenova Grupa would abolish certain limitations to allow better partnerships with suppliers.

The Agrokor boss believes that the Slovenian market is too small for Mercator. "I see Fortenova Grupa as a new and healthy platform on which Slovenian suppliers will be able to develop their business."

Fortenova Grupa will start out with a lot of debt: between EUR 1.4bn and EUR 1.5bn. The group expects to generate between EUR 320m and EUR 340m in operating profit. It will moreover sell off business operations that are not a part of its core divisions: retail, food production and agriculture.

STA, 5 March 2019 - Slovenian chief financial officers (CFOs) expect a somewhat less positive outlook of the state of the economy this year, and point to operational cost management and lack of trained workers as the main risks to business, according to the 2019 survey by consultancy services provider Deloitte Slovenija.

"The main findings of the survey, which has been carried out for the 10th time in Central Europe and for the 8th time in Slovenia, are that CFOs expect growth to slow down.

"In Slovenia, they stressed that an unstable fiscal or legislative environment in general makes their business highly uncertain," Deloitte Slovenija director Barbara Žibret Kralj said as she presented the survey in Ljubljana on Tuesday.

With the minimum wage to rise in Slovenia, Slovenian CFOs expect labour costs to rise the most among all costs. And just like in 2018, they point to hiring adequately trained staff as one of the biggest problems.

The CFOs also expect the unemployment rate to rise, and see banks as the most popular lenders, with internal sources of funding also playing an important role.

Mojca Osolnik Videmšek from the Gorenjska Banka bank said the economy was deeply in an investment cycle, so the need for banks as sources of funds, also because of low interest rates, was there to stay.

This year's survey also focused on artificial intelligence.

More than three-quarters of CFOs in Central Europe and around 40% in Slovenia say their companies lack the support of artificial intelligence in decision-making processes.

In Slovenia, two-thirds of companies say artificial intelligence is important for the development of financial services, but are poorly prepared for implementation.

Slovenian CFOs also believe artificial intelligence will create many jobs in the medium term, but a quarter maintain it will make many jobs obsolete in the long run.

While firms compete globally to attract IT experts, Juri Sidorovič from Deloitte said directors not giving clear instructions and not setting goals was sometimes a problem.

"The problem is what a goal is, what we want, what can be modernised, what can be robotised," he stressed.

Deloitte Slovenija also commented on the tax reform presented last week, with Andreja Škofič Klanjšček saying it was more of a "correction since it brings no major changes".

She welcomed the planned changes to personal income tax to finally take the pressure off of those in the middle of the income scale, and exempting holiday allowance from all taxes.

However, Škofič Klanjšček is worried about the planned rise in corporate income tax from 19% to 22% and about the minimum taxation of 5% of all legal entities.

The participants of the news conference said raising the corporate income tax "is a bad signal to attract investors".

They also complained about the lack of a strategy in which the government would set goals to be achieved with tax changes.

Sidorovič said the state could for instance decided to promote IT and then take measures to implement such a strategy.

STA, 4 March 2019 - The Slovenian insurance group Triglav collected EUR 1.07bn in insurance premiums last year or 7% more than in 2017, to increase its net profit by 16% to EUR 80.8m, according to an unaudited report published on Monday.

Premium growth was recorded in all insurance markets and segments, the report says, noting that the group's pre-tax profit was up 15% to EUR 97.5m.

The parent company Zavarovalnica Triglav posted a net profit of EUR 65.5m last year, up 5% year-on-year, while pre-tax profit amounted to EUR 78.5m, or 6% more than in 2017.

STA, 28 February 2019 - Slovenia's survey unemployment rate stood at 4.4% in the last quarter of 2018, which is the lowest rate since the last quarter of 2008, when it stood at 4.3%, the Statistics Office reported on Thursday.

Among the people aged between 15 and 29, the survey unemployment rate in the last quarter of 2018 was at 7.6%, or two percentage points lower year-on-year. The rate was the lowest in the 55-64 age group, at 3.8%.

The long-term unemployment rate dropped to 1.8% year-on-year, as the number of long-term unemployed persons was down by 35.6%, from 29,000 to 19,000.

In the last quarter of 2018, 45,000 persons were unemployed by ILO standards, which is 14,000 (24.3%) fewer year-on-year. The active population in Slovenia was up by 12,000 (1.2%) to 984,000.

The number of inactive persons was up by 4,000 or 0.6% to 729,000. More than half of them (394,000) were older than 65, while 7% or 47,000 of them were aged between 25 and 49.

More detailed data on this story can be found here, while our stories on employment in Slovenia are here