Business

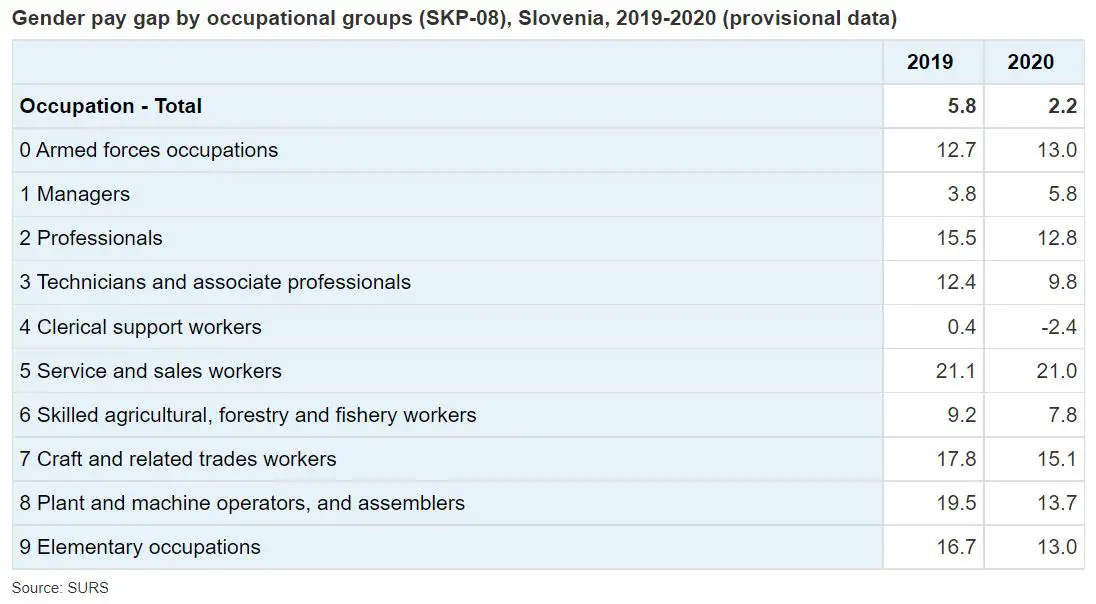

STA, 19 September - The pay gap between men and women in Slovenia narrowed slightly in 2020, by 3.6 points annually to 2.2%, preliminary figures released by the Statistics Office show. The gap in the private sector stood at 6.5% and at 10.7% in the public sector.

Average monthly net pay in the country increased by 5.4% to EUR 1,252 in 2020 over 2019.

Men's average monthly net pay was 0.7% above the average, while women's was 0.8% below the average.

Average net pay increased last year over the year before for men and women, with women's increasing by 7.3% and men's by 3.9%.

Almost 64% of Slovenia's employees received lower monthly net pay than the national average.

The median of the monthly net pay - a value splitting the population into two equal parts - stood at EUR 1,066, and was practically the same for men and women.

Men with higher education meanwhile earned the most last year, with their average monthly pay at EUR 1,774 net, 42% above the national average.

Women with the same level of education earned much less, EUR 1,529 net a month.

The average monthly net pay dropped under EUR 1,000 in the category of women with secondary education, to stand at EUR 977.

For those who have completed only primary school, it stood at EUR 917 for men and EUR 832 for women.

Average monthly pay was below the national average in more than half of all sectors, and below EUR 1,000 in four, the lowest in hospitality - EUR 884.

The electricity, gas and steam supply sector meanwhile had double the monthly net pay in hospitality, followed by financial services and insurance.

STA, 18 September 2021 - Mag-Lev Audio, a Slovenian start-up that developed the first levitating turntable in the world and collected EUR 800,000 in Kickstarter and Indie Gogo campaigns, has gone into receivership. After launching production, the company failed to find a market for its product.

The Nova Gorica District Court launched receivership proceedings on 10 September, according to the AJPES agency for legal records.

The company led by Davorin Furlan and Tomaž Pegan was one of the most successful Slovenian companies on crowdfunding platforms.

The MAG-LEV Audio team manufactured the first levitating turntable in 2016 to raise over EUR 800,000 on Kickstarter and Indie Gogo.

It launched production in a rented facility in Nova Gorica in 2018 and hired staff.

The company planned to make about 1,500 levitating turntables a month at first to sell them mostly in the US, Europe, Australia and Japan. The founders counted on their investment to return in a few months.

But things did not go as planned, as the company never found the right market. It reported on this to its buyers and supporters on crowdfunding platforms, the newspaper Finance said a few days ago.

According to Finance, the company said at the end of last June that in November and December 2019 it managed to sell at least one product a day, but sales slowed down in 2020 and the company could no longer cover its costs.

The problem was allegedly the price of the product, which should be between EUR 600 and EUR 900 for sales to pick up, which the company said would however not cover the costs due to the quality of the product and expensive technology used. The turntables were sold at EUR 1,000-3,000.

Furlan told Finance the value of the investment had been underestimated and put a part of the blame also on the epidemic. "We hope the story is not over yet and that it will continue some day despite receivership," he said.

STA, 16 September 2021 - Tour organisers can hope to get an additional EUR 10 million in aid to refund clients who have paid holiday packages which were then cancelled due to the pandemic, the Economy Ministry said on Thursday.

The ministry will provide the funds to the Slovenian Enterprise Fund, which will offer loans to tour organisers - with small, medium-sized and large companies eligible.

This should enable the tourism companies to repay the debt stemming from package holiday contracts.

Tour organisers offered their clients vouchers for the cancelled trips, but not all of them accepted them, which is in line with consumer protection legislation.

Based on Covid relief legislation, tour organisers must now refund the consumers for all payments. They have to do so in 12 months after the epidemic was declared over.

The ministry said this is the first tranche of aid, which should help primarily large tour organisers.

So far, tour organisers have not reported about any major difficulties in refunding the clients.

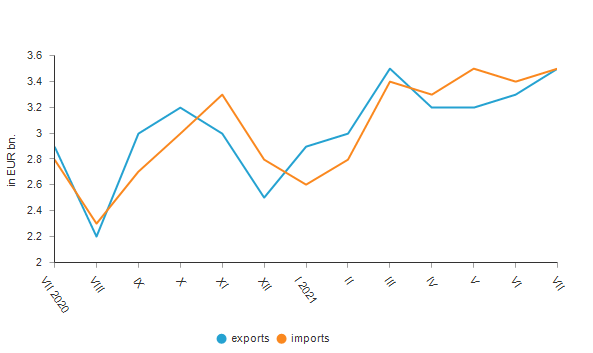

STA, 9 September 2021 - Slovenia exported goods in the value of EUR 3.5 billion in July, or 17.3% more than in the same month last year, while imports, also totalling EUR 3.5 billion, were up by 26%. The imports-to-exports coverage was 98.9%, as a EUR 40 million trade deficit was recorded in July, the Statistics Office reported on Thursday.

Slovenia's exports and imports in July were also higher than exports and imports in the same month in the pre-coronavirus year 2019, increasing by 14.2% and 13.7%, respectively.

The value of goods exported from Slovenia to other EU member states was up by 8.1% to EUR 2.2 billion, while the value of goods imported from these countries increased by 15.5% to EUR 2.2 billion.

stat.si

The share of trade between Slovenia and non-EU countries increased somewhat, with Slovenia exporting EUR 1.3 billion in goods there (36.5% more than in July 2020) and importing EUR 1.3 billion, or 49.2% more than in the same month last year.

In the first seven months of the year, Slovenia exported EUR 22.6 billion in goods and imported EUR 22.5 billion in goods, which is an increase of 18.8% and 25.1% on the annual basis, respectively.

In the January-July period, Slovenia thus recorded a EUR 200 million trade surplus for the imports-to-exports coverage of 100.8%.

STA, 3 September 2021 - During the Covid-19 epidemic, companies received various forms of state aid. Some were not so badly affected and will now have to repay the received subsidies. According to an estimate by the Slovenian Financial Administration (FURS), this amounts to just under EUR 90 million, just over 4% of the total amount paid out.

The first Act Determining the Intervention Measures to Contain the Covid-19 Epidemic and Mitigate its Consequences for Citizens and the Economy was adopted by the National Assembly shortly after the epidemic was first declared last spring. By February this year, the number of "anti-Covid laws" had risen to eight.

One of the first measures was a partial wage subsidy for furloughed workers. The eligibility criterion was initially set at a 30% drop in income compared to pre-Covid times, and then gradually reduced until the end of June, when the measure expired.

Until the end of June, the Employment Service was also paying out wage subsidies for workers who were quarantined or could not come to work due to force majeure, such as childcare.

So far, the Employment Service has paid out EUR 688.7 million for all these measures. Of these, 31,735 employers received a partial wage subsidy for furloughed workers for a total of 215,055 employees.

Meanwhile, 10,104 employers have been subsidised for reduced working hours for a total of 51,060 employees, while 11,088 employers have received wage subsidies for quarantined workers or those absent due to force majeure, for a total of 56,167 employees.

FURS is responsible for monitoring the job retention subsidies paid out and told the STA that according to their first calculations, the recipients will have to pay back a total of EUR 7.4 million in furlough subsidies and EUR 435,000 in subsidies for reduced working hours.

While virtually all sectors have been affected by the epidemic, the Employment Service received the highest number of applications for furlough and reduced hours subsidies from employers in manufacturing, trade and catering.

In addition to measures aimed to preserve jobs, other forms of support were made available to companies, and a monthly basic income was introduced specifically for the self-employed and certain other beneficiaries.

For all forms of subsidies and aid, the emergency laws set out the conditions under which they could be claimed, which were usually set at a certain proportion of income decline compared to the individual beneficiary's performance in pre-Covid times.

The government has encouraged employers to apply for aid if they are in doubt whether they are eligible, as they would be able to pay it back later without interest.

The same assurance was given in mid-April last year by Ivan Simič, then chair of the government's advisory group and now director of FURS.

"If aid recipients find they have not met the conditions, the law allows them to self-report to FURS within 30 days of submitting their return and pay a refund without interest," Simič explained, adding that interest would only be charged in the case of deliberate misrepresentation.

FURS notes that just over 25,000 different taxable persons will now have to repay the state aid they received, totalling EUR 88.6 million. This is around 4.5% of the total amount paid out, which stands just under EUR 2 billion.

Repayments can be made in several instalments, which is what most recipients choose to do. So far, FURS has received around 4,000 such applications and approved just over half of them, totalling EUR 7.2 million.

This year, FURS inspectors also intend to monitor the payment of crisis allowances, the reimbursement of expenses related to temporary measures in the field of infrastructure and the use of funds received by companies to carry out rapid antigen tests.

STA, 2 September 2021 - The government adopted on Thursday a set of changes to the gaming act that the Finance Ministry had started drawing up in 2015. The changes lift most restrictions concerning casino ownership and introduce granting concessions on the basis of public tenders.

The changes will create a legal framework to enable granting concessions for the ongoing operation of classic and special games of chance in a transparent way based on a public tender, the Government Communication Office said after today's government session.

In line with the existing 1995 gaming act, the government and the finance minister can freely decide on granting and extending concessions.

But under the new bill, the government will grant concessions for operating classic and special games of chance based on public tenders to be published three times a year.

While currently only two companies have concession for operating classic games of chance - Loterija Slovenije and Športna Loterija, now the number could increase to five.

Meanwhile, betting, a specific type of classic games of chance, is to be further regulated. In line with the proposal, special conditions will be set for obtaining concession along with more detailed conditions for their operating.

The proposed changes also eliminate the requirement that a company wanting to obtain a concession for operating special games of chance must be seated in Slovenia, which transposes EU legislation. Restrictions regarding the type of company are also removed.

For concessioners that operate special games of chance in casinos, most restrictions regarding the ownership will be lifted.

Under the current rules, owners can only be the state, local communities, fully state-owned companies and also companies, but the latter may acquire the maximum of 49% of regular shares and meet a number of conditions.

The new proposal, however, envisages that the indirect or direct state's share in the ownership structure of a concessionaire may not be lower than 25% plus one share in the case of a public limited company and no lower than 51% for any other type of company.

The changes also redefine the duration of concessions and envisages extending of concessions for the minimum of three and maximum of five years.

The lowest concession fee is set for ongoing operation of classic games of chance and other types of special games of chance. In casinos, it is set at 5% of the basis and at 20% of the basis for gaming halls, the Government Communication Office said.

STA, 31 August 2021 - Only a day after putting out a proposal on taxation of trading in cryptocurrencies, the Financial Administration (FURS) said it will amend the proposal amid a strong response from stakeholders to give taxpayers the option to choose between paying tax either on the profits they make or as a percentage of the cryptocurrency they cash in.

FURS initially proposed imposing a 10% tax rate on the amount of cryptocurrency turned into non-virtual currency or spent on goods or services, a proposal that FURS today said met with "extensive response from the interested public".

Having looked into the reactions, FURS now plans to change its proposal so that the taxpayers - individuals who are Slovenian tax residents - can either opt for the 10% tax rate on the amount of the cryptocurrency cashed in or, alternatively, pay a 25% tax on the profit they make.

The tax authority emphasized that the proposal applies only to physical persons who are Slovenian tax residents and not to legal entities.

Under the amended proposal, amounts of up to EUR 15,000 during one calendar year will not have to be reported and will not be taxed.

Given the immense development in virtual currencies in recent years, FURS said the bill sought to respond to the trend at least to some extent and simplify things. It said Slovenia wanted to be the first European country to take such and approach.

FURS offered a calculation demonstrating how two modes of taxation would function in practice. If an individual bought one Bitcoin in 2018 at the price of EUR 3,000 and cashed it in today for EUR 40,000 they would either pay EUR 4,000 tax on the amount sold or a EUR 9,250 capital gains tax.

Commenting on the original proposal in Tuesday's commentary newspaper Finance has calculated that it would mean that if you buy EUR 1,000 worth of Bitcoins and later sell them for EUR 1,100, your profit would be EUR 100 while the tax would be 110 euros.

Under current legislation taxable income from virtual currencies depends on the circumstances of each individual case but as a rule physical persons need to pay capital gains tax from selling cryptocurrencies when they make the income as business.

STA, 31 August 2021 - The newspaper Finance approves of imposing a tax on earnings from cryptocurrencies in Tuesday's commentary, but lambastes the Financial Administration's proposal for a 10% tax on the sale value of cryptocurrencies as being unreasonable.

The paper says there are several arguments in favour of taxing the crypto market, however the direction which the Financial Administration is taking with its proposal is "completely misguided".

"They want to tax 10% of the sales value of cryptocurrencies. This means that if you buy 1,000 euros' worth of Bitcoins and later sell them for 1,100 euros, your profit is 100 euros and the tax 110 euros."

Calling the idea unreasonable, the paper says trading in cryptocurrencies is much like trading in securities; no one buys them to use them as a currency and everyone buys them to sell them for a higher value later on, so there is no reason for traders not to pay tax on capital gains, at the same rate as investors in shares.

The paper says the state has been sending out a wrong message by not taxing trading in cryptocurrencies so far and is sending a wrong one now with a proposal that in many cases means state 'confiscation' of all or almost all profit.

"Since nothing is as bad as it seems let us hope the Finance Ministry will see reason and draw up a normal proposal - so that cryptocurrencies are taxed by profit, just like shares."

STA, 30 August 2021 - The Financial Administration (FURS) has proposed changing how income from cryptocurrencies is being taxed so that a 10% tax rate would be imposed when the cryptocurrency is spent or turned into cash.

The administration proposes the tax, at a rate of 10%, be paid on the amount of cryptocurrency turned into another currency or spent for goods or services.

"We would like to emphasize that it is not profit which would be taxed but rather the amount a Slovenian tax resident receives on their bank account on turning the virtual currency into cash or when buying a thing," said FURS.

They are proposing adopting the new system to tax cryptocurrencies by passing a new law.

It would be a major simplification for FURS as they would no longer need to examine the many transactions the taxpayer has performed in between or how many cryptocurrencies they have bought or sold.

There are currently more than 1,000 different cryptocurrencies, the best known of which are Bitcoin and Ethereum.

Under current legislation taxable income from virtual currencies depends on the circumstances of each individual case, but as a rule physical persons need to pay capital gains tax from selling cryptocurrencies when they make the income as a business.

This typically involves excessive number of transactions, even tens of thousands, but the increasingly digitalised world calls for simple taxation solutions, said FURS.

Under the new solution that is being proposed the taxpayer would have to prove they incurred a loss, which means that all transactions would have to be examined.

STA, 27 August 2021 - Revenue from the sales of services in Slovenia was up by 21.8% in June compared to the same month last year, and by 2.6% compared to June 2019, the Statistics Office reported on Friday, an indication that services are recovering fast from the pandemic slump.

All observed groups of services contributed to the growth in revenue from the sales of services in June, with the largest growth being recorded in real estate brokerage (49%).

In the hospitality industry, revenue grew by 24.7% in June year-on-year, and in professional, scientific and technical activities it was up by 24.5%.

In transport and warehousing it increased by 23.6%, in other miscellaneous business activities by 18.4% and in information and communication by 12%, the Statistics Office notes.

In the first half of 2021, revenue from the sales of services was up by 13.5% year-on-year, and it was higher in all observed groups except the hospitality industry. It was meanwhile 1.2% below the figure from the first half of 2019.

STA, 25 August - The recovery of tourism from the current crisis will take much longer than expected and may even take a generation, warned Gregor Jamnik, head of the Slovenian Hoteliers' Association. He also pointed to the difficulties in recruiting staff, especially young people, and the uncertainty in the tourism and hospitality industry.

"Covid-19 has changed tourism in a global sense - we're not talking just about lower demand, there's the collapse of the airline industry, the closure of hotels, bars and so on," Jamnik said during a debate We Are All Tourism, hosted by the Digital Innovation Hub (DIH) Slovenia on Wednesday.

Initially, it was thought that the recovery would take three to five years, but Jamnik estimates that it could take much longer. It is even likely to be the longest recovery in the history of tourism and hospitality, he said.

He pointed to the uncertainty that the epidemic is causing in the industry: "People who have worked or want to work in our industry can see the insecurity, and this will affect a whole generation."

Jamnik also pointed to the difficulties in finding cleaners, maids and kitchen assistants, saying that these jobs were completely undesirable among Slovenians.

Importing staff could be a solution, but this can create cultural and language problems.

Another problem is that young people seek jobs where they can be promoted quickly and their desire cannot be met. They also refuse to work weekends, holidays and night shifts, he added.

In his view, there is also a lack of human resources training in Slovenia, which is an important way of communicating with employees about what is required and expected of them. He also pointed to the fact that Slovenia does not have a hotel management school.

Jamnik sees the automation of some parts of the industry as a possible solution to the staffing problems, but a larger piece of the pie will also have to go for employees' wages, he believes.

"We can't instantly improve working conditions, but we can increase the number of employees, so they could have a couple more days off work," he said.