Ljubljana related

STA, 19 May 2020 - The Financial Administration (FURS) collected EUR 1.2 billion in April, which is 25% less than in the same month last year, the drop being attributed to the slowdown of business due to the coronavirus epidemic. A 4% drop in collected taxes and other levies was already recorded in March, half of which was affected by the anti-epidemic measures.

FURS collected EUR 573 million in taxes last month, which is over two-fifths less than in April 2019. The amount of income tax collected was down by 55%, which includes an almost 80% drop in corporate income tax collected.

The drop in the collected value added tax (VAT) in the month in which a majority of shops were closed was somewhat smaller, with EUR 228.1 million in VAT being poured in the national budget, or 35.5% less than in the same month last year.

While the amount of the collected VAT was growing in the first two months of the year, it dropped by almost 30% in March compared to February to EUR 187 million. It increased again in April but did not reach the February level.

As more shops were being gradually opened, with those with the surface of up to 400 sq metres being opened on May and all shops being opened as of Monday, a growth in the collected VAT on the monthly level is expected in May.

FURS also collected EUR 390 million in social security contributions in April, which is more than a third less than in March and in February, reflecting the situation on the labour market.

By last week, the number of the unemployed person increased to more than 90,000, and the steepest growth was recorded in the first half of April.

In the first four months of the year, FURS collected a total of EUR 5.5 billion, which is EUR 298.8 million or 5.2% less than in the same period in 2019. Tax revenue was down by 12.7% to EUR 2.8 billion, and social security contributions by 3.5% to EUR 2.2 billion.

STA, 16 May 2020 - Revenue from VAT in March, when most shops closed as Slovenia went into lockdown on 16 March, dropped to EUR 187 million, down nearly 30% over February and 19% over March 2019, the latest data from the Financial Administration (FURS) showed.

Almost EUR 705 million in VAT was meanwhile collected in January and February, up 4.8% from the same period last year.

The majority of shops, except groceries, pharmacies and petrol stations, closed in the middle of the March after the coronavirus epidemic was declared.

Eurostat statistics realased earlier this month showed the entire EU retail sector was severely affected by lockdown in March at monthly and annual levels.

Slovenia's posted an annual drop in sales of 15.1%, the second steepest fall in the entire EU, behind France (-16%), which compares to the average EU drop of 8.2%.

At the monthly level, Slovenia's drop in retail sales hit 13.5%.

Shops have been gradually reopening since mid-March, with all allowed to reopen on Monday, 18 May.

Nevertheless, analysts do not expect consumption to pick up anytime soon.

Slovenia's domestic consumption increased by 2.7% in 2019, but the government's macroeconomic forecaster, IMAD, expects it to drop by 3.1% this year and a further 0.4% in 2021.

If you’re an SP in Slovenia whose income fell by at least 25% in March compared to February – the key month in all this aid – then you’re eligible for a €350 payment under the first coronavirus stimulus package, plus you won’t need to pay your social security contribution in April. Important to note that another criterion is you must be up to date with your taxes, and you’ll still need to pay your taxes. You can also apply for €700 in April and May, with details below.

Go to this page on eDavki, scroll down and click on your SP identity. Note that my personal details have been distorted in all these images.

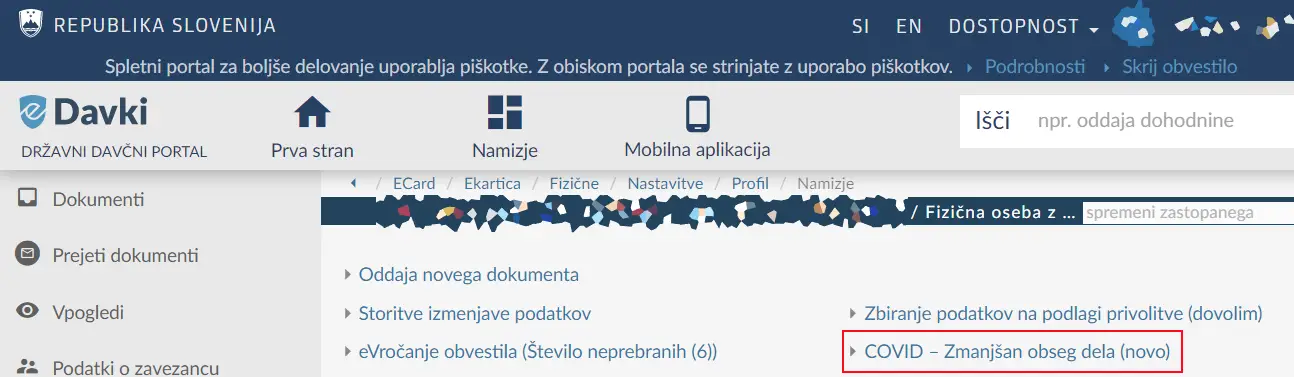

Then you’ll be taken to this page, where you’ll need to click on the COVID link, as highlighted below.

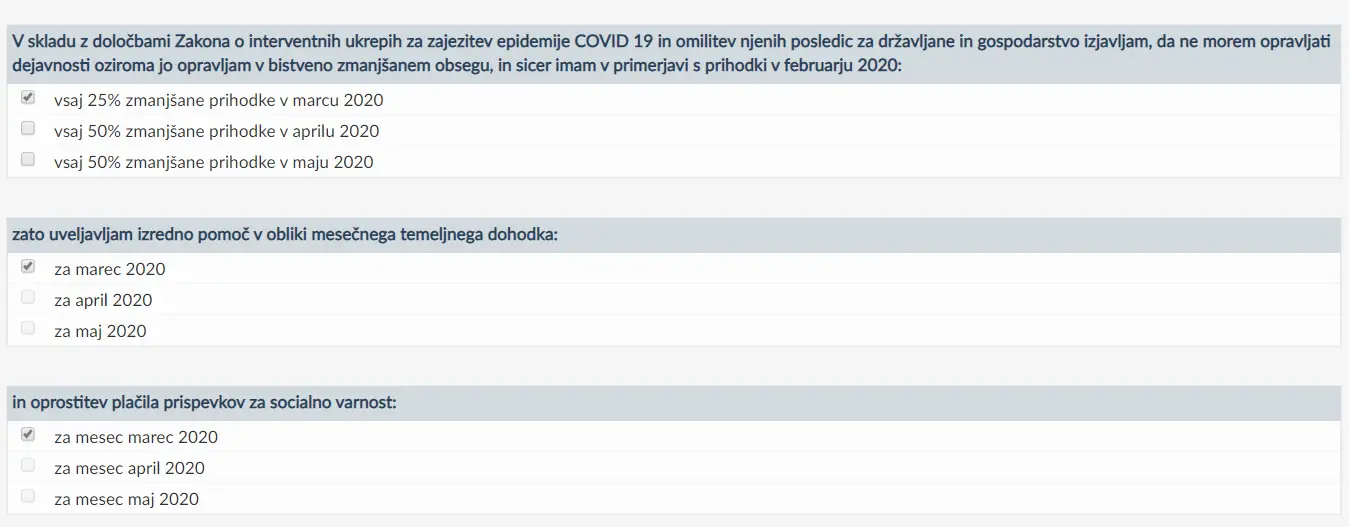

Here you’ll need to enter your phone number, if not already in the system. Then we come to the meat of the page, three items about what you’re claiming. The first asks about your decline in income in March, April and May compared to February. If it fell 25% in March you can get €350, and if it’ll fall 50% in April and May then you can get €700 in those months. I don’t have crystal ball, so only applied for March. I’ll come back next month if the figures tell a sad story.

Underneath that are two more items, which only open up for the months you selected for item 1. Item 2 asks you to choose the months for which you want to apply for aid, while for item 2 you check the months in which you don’t want pay your social security contributions (without penalty). Remember that you still need to pay your taxes.

Underneath those three items there's another with a drop-down menu for you to choose which bank account you want to receive the money in. After that, you just need to click on “oddaj vlogo” (submit the application) and your claim has been filed.

You can learn more about this aid here, while the page you need to visit on eDavki is here

STA, 14 April 2020 - Those eligible for state aid under the EUR 3 billion fiscal stimulus package designed to mitigate the coronavirus crisis for businesses and households have started filing their requests. The Employment Service received 1,154 applications from companies with idle employees between Saturday and Monday.

If you're an SP you can find out how to apply for this aid here - fast, easy and online

Before the stimulus package came into force on Saturday, companies had been filing requests for aid under a less favourable emergency law passed earlier. Unofficially, 8,441 such requests had been filed.

The Employment service told the STA today the data was yet to be analysed, as some employers had filed multiple requests.

Under the emergency law, which took effect on 29 March, idle workers were to get 80% wage compensation, of which 40% would be covered by the state and 60% by their company.

However, under the new stimulus package act the state is to cover the entire 80% compensation, based on a worker's average monthly pay from the last three months.

Some companies have filed separate requests for aid under each of the two laws, although the Employment Service says all applications will be processed under the new law.

All efforts are being put in the processing of applications to make sure employers receive decisions as soon as possible, the Employment Service said.

"We have also significantly expanded our team in charge of registration procedures, as we are dealing with increasingly many applications for registration of businesses these days," it added.

The Employment Service is also offering technical support over the phone or online to those who want to start a business or file for wage compensation.

Eligible for state aid are companies that saw more than a 20% drop in revenue in the first six months of the year and whose revenue in the second half of the year will not rise by more than 50% year-on-year.

Companies founded this year will have to have at least 25% drop in revenue in March and at least 50% revenue drop in April or May compared to February to receive aid.

Only companies that owe no liabilities to the state, are not in receivership, and are not a direct or indirect user of the state budget or municipal budget of the municipality which receives more than 70% of the funds from the state will be able to get aid.

Banks and insurance companies are not eligible.

The self-employed, who will be exempt of payment of all social security contributions for April and May, and will receive a monthly "basic income" of EUR 350 in March and EUR 700 in April and May each, can expect aid from 25 April.

But only those who suffered at last a 25% drop in revenue in March compared to February, and at least a 50% drop in April or May compared to February, are eligible.

If their revenue in the first six months of the year exceeds that from the first half of 2019 by more than 20%, and if their revenue in the second half of the year increases by more than 20% year on year, they will have to return the money.

Religious workers and farmers are also eligible for the "basic income" and will be excused from payment of contributions if they submit a statement by the end of May, saying they cannot perform their activities as usual because of the coronavirus epidemic.

The "basic income" will be paid out by the Financial Administration (FURS). Those who submit the statement by 18 April should receive it on 25 April.

FURS told the STA it had so far received 13,500 requests from the self-employed. Statistics Office data shows there were slightly fewer than 31,000 self-employed in the country at the end of 2019.

We’ll have details of how to file for this online very soon

The tax office issued a reminder that Thursday 9 April, and not tomorrow is the last date for tax payments (akontacija) by sole proprietors (SP). Anyone who will be late with the payment will not be able to apply for government subsidies related to pandemic relief. This is because tomorrow is a bank holiday, due to Easter.

The application form for two kinds of aid, social contributions waiver and monthly basic income, will be available on eDavki from April 14.

You can apply for a contributions waiver for March for the period from 13 March onwards (due on April 20), April (due on May 20) and for May (due on June 20). If you want to apply for a contributions exemption for March and April, you must submit a statement via eDavaki by April 30. The application deadline for the May contributions waiver is May 31. All applications can be made in one statement.

SPs can also apply via the same statement for the monthly basic income, which amounts to €350 for March, and €700 for April and May.

The conditions for the monthly basic income are the same as the contributions waiver.

- at least a 25% reduction of income in March 2020 compared to February 2020, or

- at least a 50% reduction of income in April or May 2020 compared with the income of February 2020.

Those eligible for help are SPs whose income will decline by more than 20% in the first half of 2020 compared to the same period in 2019 and will not exceed 20% growth of revenue in the second half of 2020 compared to the same period in 2019 although this is not clear on the official website. If this condition is not met, the beneficiary will have to repay all the aid they have received.

From the website of the Financial Administration of the Republic of Slovenia.

STA, 26 February - The coalition government that is being formed by Janez Janša is planning to reintroduce military conscription, effectively secure the border, decentralise the country and increase local government funding, as well as introduce a general child benefit.

This follows from a 13-page draft coalition agreement obtained by the STA. The draft was initialled on Monday by Janša's Democrats (SDS), New Slovenia (NSi), Modern Centre Party (SMC) and Pensioners Party (DeSUS), but unofficial information indicates the parties have already signed the agreement.

Under the draft, the partners plan to gradually reintroduce conscription, which Slovenia abandoned in 2003, and a six-month military service. They also pledge to "tackle the situation" in the police force and consistently implement asylum procedures.

More on the conscription plans here

The parties have also committed to implement the Constitutional Court ruling mandating equal funding of private and public primary schools, and complete the system to fund science and research.

The per-capita funding of municipalities is to be raised to EUR 623.96 in 2020 and EUR 628.20 in 2021, which compares to EUR 589.11 and EUR 588.30, respectively, under the valid budget implementation act.

The coalition pledge to put in place a housing scheme for young families, build rental flats and establish a demographic and pension fund, headquartered in Maribor. Slovenia's second city will also host a government demographic fund. Pension rights are not to be changed.

The coalition also plan to reform social transfers policy and introduce free kindergarten for second or more children simultaneously enrolled in pre-school care and education. Family-friendly policies also include plans to introduce a universal child allowance.

The coalition pledge to secure extra financing from pubic and other funds in order to establish a financially sustainable and stable financing of the national health system and long-term care, and take effective measures to cut short waiting times in healthcare by engaging all staff resources.

The commitments include adopting legislation on long-term care and reforming the healthcare and health insurance act to change the management and functioning of the Health Insurance Institute and transform top-up health insurance.

Under the plans, employees will be able to take three days of sick leave without seeing a doctor, but only up to nine days a year. Measures are also planned to increase the vaccination rate and to set up an agency for quality of medical services.

The coalition have also committed to reduce taxes on performance bonuses and to reform the public sector wage system by pegging part of pay to performance.

Plans in the judiciary include making court rulings fully public and giving judges the option to pass dissenting opinions. Legislative changes are to affect the Judicial Council, state prosecution service, insolvency law and penal procedure.

The foreign policy agenda includes a pledge to support Western Balkan countries in their integration in the EU and NATO.

Other concrete projects include introducing e-motorway toll stickers and considering the option to transfer the Koper-Divača railway project and its manager 2TDK to the national railways operator.

The coalition would also like to reform land policies and the Farmland Fund, amend the co-operatives act and regulate production and use of cannabis in medicine and industry.

The coalition agreement sets out that the partners are taking the responsibility to manage the state according to voters' will, constitutional values, and rights and obligations as set forth in the agreement, based on the principles of equality and partnership.

The coalition pledges to focus on what connects and unites people in the country, and to advocate cooperation based on the willingness to work for the common good.

Under the draft, the SDS will be responsible for the departments of home and foreign affairs, finance, culture, which includes media, as well as the environment, diaspora and cohesion. The SMC was allocated the briefs of education, economy, public administration and justice, the NSi labour, infrastructure and defence, and DeSUS health, agriculture and the demographic fund.

This is the first in a series on the new government’s plans, to be posted in the next few days, with the whole set here

What Mladina & Demokracija Are Saying This Week: Pahor Undermines Govt vs How the Rich Help the Poor

The covers and editorials from leading weeklies of the Left and Right for the work-week ending Friday, 10 January 2020

Mladina: Pahor is undermining government

STA, 10 January 2020 - In Friday's editorial, the left-leaning Mladina analyses two of President Borut Pahor's recent public appearances only to draw the conclusion that he is undermining the Marjan Šarec government to pave the way for Janez Janša of the opposition Democrats (SDS). The party won the 2018 election.

In his 30 December interview for TV Slovenija, Pahor clearly indicated that he does not like Prime Minister Šarec and that Šarec should leave the premiership to Janša.

"This was harsh manipulation by the president and an attempt to picture the situation in the country as strained and abnormal," says editor-in-chief Grega Repovž.

His attempt to fuel uncertainty and question the government's legitimacy has failed, having had no response, but the president nevertheless behaved oddly.

Pahor hinted at his discontent a few days earlier in his Independence Day speech, in which he presented his view that consensus politics was in a serious crisis.

Repovž admits Slovenia has a far-right party which spreads intolerance, namely the SDS, various militias have been popping up and hate speech is a problem.

"But this is not what Pahor meant. On the contrary, he wanted to say that he does not find it right that political parties refuse to cooperate with the SDS and Janša."

In the interview Pahor took a step further; while admitting the coalition has secured political stability, he indicated the government should now embark on reforms even at the cost of its own collapse.

Mladina says in the editorial headlined Pahor, the Manipulator that the president's statements are full of manipulation and deceit.

He pictured political stability as a source of instability, and said reforms were needed for Slovenia's revival, but Repovž wonders what revival he had in mind when Slovenia has one of the highest GDP growth rates and one of the lowest public debts in Europe.

Repovž believes Pahor's manipulation is aimed at creating the impression that Slovenian politics is in an emergency situation which needs to be stopped right now, so he in effect advised Šarec to cause his government'collapse by himself.

Mladina admits neither the government not Šarec is ideal, and ministers do not deserve As, which should provide Pahor with enough material for justified criticism.

"But Pahor is not interested in content, he is bothered by Šarec and by the fact the government is not led by his favourite politician Janša. This is the bottom line.

"He is thus willing to portray the situation as an emergency. What is most worrying is his superiority and his attempt to show that it is not legitimate if the government is run by this coalition, which is something a serious president cannot afford."

Demokracija: How the rich help the poor

STA, 9 January 2020 - As first consumers of very expensive goods, the rich have in fact helped reduce social inequality, so there is no need to raise taxes for them to channel more money towards the poor, the right-leaning weekly Demokracija argues in its editorial on Thursday.

It was an invaluable experience to listen to all sorts of leftists before the New Year saying they would continue their fight against exploitative capitalism, says the editor-in-chief Jože Biščak.

Wicked capitalism, as opposition Left leader Luka Mesec termed it, is apparently also reflected in social inequality measured by wealth.

Since we are not as far as redistributing it by looting, Mesec is reciting his mantra of "fair taxation" under which the rich should pay more.

It is of course typical of socialists to fight against capitalism with other people's money, which defies the logic of market economy.

But the statistically-corroborated fact is that never in the world have so few people lived under the poverty threshold and have goods been more available to everyone.

"And the credit goes solely to the rich, who play the role of 'food tasters in royal courts'," the magazine's editor-in-chief says in the eponymous commentary.

They can be credited with having been able to afford a terribly expensive innovation such as a TV set or a mobile phone at a certain moment in history, and their response enabled producers to assess the future demand.

Them being pioneer consumers benefits all, making goods more accessible also for the poorer classes. "So eventually, if I use the speak of the leftists, this helps reduce social inequality," Biščak concludes.

All our posts in this series are here

STA, 8 January 2020 - Slovenia's Financial Administration (FURS) collected EUR 17.6 billion in taxes in 2019, which is by EUR 954 million or 5.7% more than in 2018, its early figures show.

The trend has been present ever since FURS was set up with the merger of the national tax and customs administrations in 2014. Since then its tax collection rose by 29%.

Last year all public budgets - the national budget as well as the municipal, pension and health budgets - posted rises in revenue, with excise duties being one of few major taxes the collection of which dropped (-1.1%).

Social security contributions collected - which provide for pension, disability and health insurance and are largely paid directly to the public pension and health funds, but some also to the national budget - increased by 7.2% to over EUR 7 billion.

FURS also collected by 9.4% more taxes on income and profit; a significant rise of 5.9% was recorded in personal income tax, while corporate tax collected rose by 17%.

The VAT take increased by 2.8%.

FURS pointed out in a press release that last year's 5.7% rise in taxes it collected was higher than Slovenia's GDP growth, which reached 2.7% in the first three quarters of the year.

The national revenue service also said that more than 95% of all taxes had been paid voluntarily last year.

It noted another positive trend of a falling tax debt ever since FURS was established. Last year, it dropped by 3.1% to some EUR 1.2 billion, and by 18% since 2014.

All our stories on taxes in Slovenia are here

STA, 7 January 2020 - Following some three months of police search, runaway tax debtor Zlatan Kudić was apprehended on New Year's Eve, reportedly in central Ljubljana. One of the biggest tax debtors in the country, Kudić will await the end of his tax fraud trial in detention.

National broadcaster TV Slovenija reported on Tuesday that the Ljubljana District Court, where the trial began in 2013, did not want to reveal when the proceedings will resume since the defence had requested the panel of judges to be excluded, with the court president still deliberating on the issue.

Kudić vanished when the trial was drawing to an end. The former director of the Ljubljana company Maxicon, which went bust in 2012, is standing trial for tax evasion, money laundering and destruction of evidence.

The Financial Administration (FURS) should not hold out much hope of recovering EUR 25 million worth of debt owed by Kudić, said TV Slovenija, since Maxicon was erased from the list of tax debtors upon going into receivership.

FURS could claim the debt via a pecuniary claim in a criminal procedure, but it is questionable whether Kudić formally has any assets left at all.

It is not yet clear where the defendant was hiding from the arrest warrant. His attorney told the public broadcaster that Kudić did spend some time in Slovenia, at least in December.

All our stories about taxes in Slovenia are here

STA, 1 January 2020 - Recently adopted tax changes that slightly reduce the taxation of labour in favour of higher taxes on capital officially enter into effect on Wednesday.

The thresholds for all five personal income tax brackets have been increased, effectively subjecting a higher share of income to lower tax rates.

In the second and third tax brackets, which cover mostly the middle class, the tax rate will drop by a percentage point to 26% and 33% respectively.

Those on the minimum wage will see their earnings rise only marginally, while those on average pay can expect roughly EUR 150 more per year.

The threshold for the highest income bracket, which comes with a 50% tax rate, has been slightly raised to EUR 72,000; there are only about 3,900 individuals who fall into this tax bracket, or 0.3% of all income-tax payers.

The income tax changes are coupled with higher capital gains tax, which will rise to 27.5% from 25%. This rate will also apply to rental income.

Additionally, companies will be subject to a minimum corporate income tax rate of 7%, as tax credits for investments and losses from previous years will be reduced.