Business

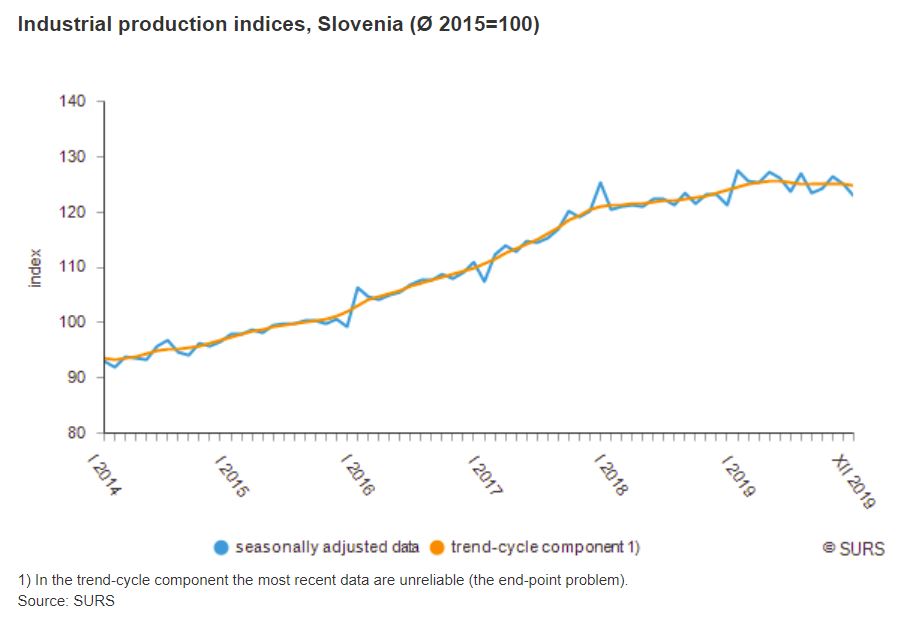

STA, 10 February 2020 - Slovenia's industrial output increased by 3% last year, the sixth consecutive year of growth. The output in December was 1% higher than in the same month a year ago but 1.8% lower than in November.

Fresh data from the Statistics Office show an annual growth in the value of industrial production, stocks and turnover in industry.

The 3% growth rate in industrial output last year is a slowdown compared to the 5% growth rate recorded in 2018 and a six-year high rate of 8.4% in 2017.

The growth was driven by a 3.4% growth in manufacturing, while the electricity, gas, steam and air conditioning supply sector and mining and quarrying contracted by 0.8% and 3.6%, respectively.

Industrial turnover increased by 2.3%, owing to a 3.1% growth in the foreign market and a 1% growth in the domestic market. Sales revenue rose across all main industrial groupings, the most in consumer goods industries, at 4.5%.

In December, industrial turnover was 1.8% lower than in November and 1.5% higher than in December 2018.

The value of stocks rose by 4.1% last year. In December their value fell by 0.5% compared to the month before but rose by 2.9% year-on-year.

More on the data can be found here

STA, 6 February 2020 - The outgoing government on Thursday approved Slovenian Sovereign Holding's (SSH) asset management plan for 2020, which also contains a long-awaited plan to consolidate, manage and restructure state-owned tourism companies.

The tourism consolidation plan has been months in the making, but the government did not provide any details about it after today's session.

Similarly, Economy Minister Zdravko Počivalšek, the initiator of the changes, did not reveal any details when leaving the session, saying only that the plan had been discussed.

His ministry told the STA earlier this week that the tourism consolidation plan pursued goals from the 2017-2021 strategy on sustainable tourism growth.

The strategy governs the consolidation of state-owned tourism companies in terms of ownership and management under the roof of a special state holding.

The state's tourism assets would be consolidated within a holding which would stem from a special company the bad bank has set up after seizing Istrabenz Turizem shares.

Transfer of the shares of tourism companies Istrabenz Turizem and Thermana is pending, awaiting government approval of the tourism consolidation plan.

The new holding is also expected to feature the state's stakes in Sava Turizem (including Hoteli Bernardin), Hit Alpinea, Terme Olimia, Adria Ankaran and Unitur.

Počivalšek believes the consolidation should help the companies improve their performance and increase value, which would be a good basis for a "well thought-out" privatisation.

The newspaper Delo reported that the goal was to increase the value of the companies by EUR 400 million in eight years.

To buy the remaining stakes the state does not yet hold in these companies, for instance the York fund's over 40% stake in Sava or Unitur, the business daily Finance said EUR 40-60 million could be needed.

Delo said that investments of the tourism companies pooled by the new holding, some of which are still quite indebted, are planned to over EUR 200 million.

The European Bank for Reconstruction and Development (EBRD) is reportedly interested in recapitalising the holding, which would give more leverage for investment.

In today's press release, SSH said the consolidation and restructuring of the state's tourism portfolio would be carried out in several stages.

The key goals will be increasing the portfolio's value and improving its profitability as well as further development of the tourist industry in line with the strategy.

It also said the state's tourism portfolio represented a significant part of the Slovenian industry, so its consolidation would have a positive impact on the entire industry.

Meanwhile, SSH's annual asset management plan, which specifies management of individual sectors and of specific investments, sets the target return on equity for 2020 at 5.9%.

This is 0.3 of a percentage point less than in 2019, but SSH boss Gabrijel Škof has recently said this is due to lower anticipated economic growth, one-off events in 2019 and regulatory requirements.

The custodian of state assets plans dividends at EUR 142.4 million, of which EUR 102.9 million would go directly to the state and EUR 39.5 million to SSH.

Last year's dividends amounted to EUR 250.4 million as a result of the sale of banks NLB and Abanka, while no major sales of state assets are planned for this year.

In the release SSH said that following the privatisation of the two banks, the share of financial companies in its portfolio had significantly dropped as had the share of important and portfolio investments, whereas the holding continues to manage many strategic investments, the return on equity of which is usually lower.

The annual asset management plan consists of a general public part and a special part which details each individual asset, SSH explained.

It said that the government had also adopted criteria to assess the performance of companies with a state stake.

Leaving the government session, Infrastructure Minister Alenka Bratušek told the press her proposal to put quality services before profit in companies carrying out public service, such as the national railway and postal companies, had not been included in the SSH's annual plan.

STA, 5 February 2020 - Banks have been complaining for years about negative interest rates, which have been eroding their earnings. In some countries they have therefore started charging fees for household sight deposits. In Slovenia, this is unlikely to happen, at least for the vast majority of deposits, shows a central bank analysis.

A survey of commercial banks conducted by the Slovenian central bank shows that at least sight deposits up to EUR 100,000 should be safe from any such measures.

Just one in ten banks involved in the survey said they were considering negative interest and two in ten said they were considering deposit fees, shows the survey presented on Tuesday.

And even if some banks decide to start charging for deposits, the central bank is bullish about the impact this would have on the banking sector.

That is because banks elsewhere in Europe which have already introduced deposit fees have not seen significant outflows of cash, according to vice-governor Primož Dolenc.

And the measure would only affect a small proportion of savers: only 1% of deposits are in excess of EUR 100,000.

What is more, bank clients are slow to react to changed interest rates since real rates are already negative. This implies that some would even accept deposit fees, according to Dolenc.

And even if banks started charging negative interest, most said they would change their policies, meaning they would try to entice clients to convert sight deposits into term deposits.

Bank clients also have few other ways to invest their deposits with the same degree of risk. "Alternative investments would have to be similar to deposits - with high liquidity and low risk," but they do not currently exist, said Dolenc.

This is also why the central bank is not concerned about the impact negative interest might have on bank capital adequacy and liquidity.

"Banks would respond actively, liquidity of the banking sector is reasonably high and access to alternative sources of financing is good at the moment," Dolenc said.

The central bank does not plan on issuing any recommendations to commercial banks regarding negative interest. "Interest rate policy is in the domain of banks," according to Dolenc.

STA, 5 February 2020 - Slovenian executives are quite pessimistic about the prospects for global economic growth this year as more than half think growth will slow down, shows a survey conducted by PricewaterhouseCoopers (PwC).

"The sentiment of this year's survey of Slovenian directors is best summarised with the word uncertainty," head of legal services at PWC Slovenia, Sanja Savič, told the press on Wednesday.

Last year 47% of directors thought that global growth will deteriorate over the next 12 months, this year 53% think so.

The Slovenian figures are very much aligned with global trends. In last year's PwC survey just 29% of directors were pessimistic, this year the share rose to 53%, in what is the biggest jump in pessimism since 2012.

Savič said uncertainty was present across all segments of the economy and is the consequence of "tensions in international trade, political turmoil, increasing protectionism, coronavirus, terrorism, cyberattacks and increased regulation".

The factors most commonly highlighted by Slovenian directors as having an impact on growth of their companies include uncertain economic growth (78%) and higher taxes (76%). Technological change (67%) and availability of skilled staff (60%) also rank high.

Savič pointed out that Slovenian directors do not perceive cyberattacks as a major threat, as they ranked last among perceived threats (49% mentioned them). Globally, however, the share is much higher, 73%.

Slovenian directors plan to employ a variety of strategies to counter the growing uncertainty, foremost among them organic growth, which is the choice of 69% of Slovenian respondents.

"Interestingly, 50% of Slovenian directors said they would forge new strategic partnerships this year. What this means remains to be seen," Savič said.

Several directors were on hand for the presentation and highlighted the business environment as the overarching problem.

"We don't need much, all we need is a stable and predictable business environment," said Dejan Turk, the director of mobile operator A1 Slovenija.

Likewise, Sašo Berger of IT company S&T said high taxes were not a problem, the business environment was.

This is the second time Slovenia was included in the PwC survey, which has been conducted for over two decades. A total of 45 directors took part in Slovenia and almost 1,600 globally.

STA, 5 February 2020 - Addressing the press on Wednesday amid continuing speculation about the plans of Novartis, representatives of the Swiss multinational's Slovenian subsidiary Lek said Novartis would continue a reform in Slovenia that included the transformation of production locations and more focus on innovative drugs along with generics.

"The changes that we feel the most are Novartis's ongoing portfolio changes. In this context I see Lek in Slovenia integrated to a greater extent in the innovative segment," Lek head Robert Ljoljo said.

"This does not mean that we're leaving generic products entirely ... but we'll definitely see a transformation of production locations and an additional increase in the number of innovative drugs produced," he added.

Lek started producing 10 innovative drugs last year, making for a total of 26. The development of generic pharmaceuticals is also continuing, with registration applications filed last year for 21, the development and research executive Uroš Urleb explained.

Novartis plans to continue with investment. Last year it expanded the development centre in Ljubljana and set up an automatised analysis lab, while this spring it expects to wrap up an investment into the development of biological medicinal products in Mengeš.

Commenting on the change of plans in Prevalje, where Lek built a new hall to then announce it was actually phasing out the production of antibiotics there, Lek management board member Raul Intriago Lombeida repeated this location would be part of Novartis's future global centre for technical operations.

As regards a potential sale of the newly built hall, Ljoljo said that talks with TAB, the Mežica-based maker of starter batteries for cars and industrial batteries, were still ongoing.

Meanwhile, Intriago Lombeida did not wish to comment directly on the visit of potential Chinese investors at the production unit for active ingredients in Mengeš. He said such visits by agency representatives, suppliers etc. were an everyday affair.

Lek's results in 2019 were also not discussed concretely, with Ljoljo announcing they would be presented in the annual report, presumably in August. He did say the trends were in line with those for Novartis, which increased net sales by 9% while seeing a decrease net profit by 7% to EUR 11.7 bn.

STA, 4 February 2020 - A business delegation led by state secretary at the Economic Development and Technology Ministry Aleš Cantarutti is visiting Japan this week. They kicked off their trip with visits to Yaskawa Electric, Kansai Paint and Daihen on Monday.

All three companies have already invested in Slovenia. Japanese investments have grown more than tenfold since 2013, reaching EUR 339.5 million in 2018, central bank data shows.

Slovenia classified Japan as a strategic priority market in its business internationalisation action plan in 2015, the Economy Ministry noted in a press release on Tuesday.

At Yaskawa Electric, which has a robotics plant in Kočevje, Cantarutti talked about business sentiment in Slovenia, adding that the country wished Yaskawa would continue investing in Kočevje.

Cantarutti also met Kunishi Mori, president of Kansai Paint, the owner of coatings maker Helios Domžale, the press release said. Cantarutti and Mori shared the view that Helios was an example of best practices in terms of launching new centres focusing on innovation and R&D.

The state secretary also invited Mori to the Bled Strategic Forum, the key foreign policy event in Slovenia, taking place in Bled every September.

At Daihen, the investor in the Lendava-based Varstroj Daihen, the company presented their beginnings to the delegation and showed it around the floor shop.

Cantarutti invited representatives of Yaskawa Electric, Kansai Paint and Daihen to visit the Slovenian House during the Olympics in Tokyo this summer.

The newspaper Delo said today that Economy Minister Zdravko Počivalšek had planned to lead the delegation. The head of the Modern Centre Party (SMC) changed his plans after Prime Minister Marjan Šarec resigned last week.

All our stories on Japan and Slovenia are here

STA, 4 February 2020 - The Slovenian national postal operator has stopped accepting mail for China until further notice after its partner air carriers suspended flights to the country in the wake of the coronavirus outbreak.

Until further notice, Pošta Slovenije will no longer accept letters and packages destined for China. Deliveries already on their way to China are expected to arrive with a delay, the company said.

An exception to the suspension of the service applies to UPS packages, but the senders are advised to check first whether delivery to the intended addresses is possible.

Most recent information is that deliveries cannot be accepted in Wuhan, the city and the region at the centre of the novelty coronavirus outbreak.

Fraport Slovenija, the company operating Ljubljana airport, has said that some exporters have had difficulties dispatching their deliveries because of suspension of air links with China.

Speaking with the STA, the company could not say what quantities had been affected.

"There have been many more air mail bags from China this year, which is delayed mail from last year due to overbooked capacities for Europe. The real picture will not be clear until next month."

Meanwhile, Pošta Slovenije is looking for substitute transport channels so as to be able to resume service and allow users to post all types of mail.

"The customers will be notified as soon as the possibility of mail acceptance is resorted," the postal company said in a press release on Tuesday.

Koper port says coronavirus to affect business, no measures adopted yet

STA, 4 February 2020 - Luka Koper, the operator of Slovenia's sole commercial port, has told the STA that the coronavirus situation is expected to affect transshipment volumes. Container cargo and vehicles are likely to be impacted the most, Luka Koper said, while explaining it had not yet received any instructions concerning potential health measures.

"The epidemic in China has gravely impacted production there and crippled services, including in logistics, which will sooner or later also be felt in Koper," the operator said.

While it is too early to say anything concrete, Luka Koper pointed out that some global logistics companies have already closed their distribution centres in China and that some shipowners are announcing the cancellation of certain scheduled lines.

"For the time being this does not involve the northern Adriatic or Koper but it is clear that the situation will affect transshipment volumes. Container cargo and vehicles are likely to be impacted the most," it announced.

As regards measures to contain the virus, Luka Koper explained that the monitoring of ships in Slovenia, including of the health situation of crews, is in the domain of the Slovenian Maritime Administration.

It is the duty of the captain of a ship to report any health conditions before entering the port and the report is forwarded by the Maritime Administration to the National Institute of Public Health.

The institute is also responsible for issuing instructions regarding any measures to the port, but Luka Koper said it had not received any so far.

STA, 4 February 2020 - The bankruptcy estate of air carrier Adria Airways is worth EUR 6.23 million, of which EUR 3.15 million is the title to its office building at Ljubljana airport. Official receiver Janez Pustatičnik believes that due to its complexity, the receivership procedure is unlikely to be completed before the end of 2024.

The assets also include Adria's brand, the liquidation value of which is EUR 100,000, a flight simulator (EUR 93,000) and Adria's 100% stake in its flight school (EUR 133,500), according to an opening report Pustatičnik published on the website of the AJPES agency for legal records on Tuesday.

Among its assets are also the operating licences, foremost the air operator's certificate (AOC), but have already been sold; last month they were bought by Air Adriatic, a company owned by Slovenian entrepreneur Izet Rastoder, for EUR 45,000.

Inventories are estimated at over EUR 1 million, but since they have not yet been fully documented, their estimated value could still change.

The bankruptcy estate also features operating receivables to the tune of EUR 1.44 million, which have however already been recovered.

Pustatičnik assesses the receivership procedure as very complex and demanding, so it could be completed only at the end of 2024.

He sees litigations, numerous recoveries and other procedures expected to be launched in Slovenia and abroad as the main hurdle to bringing it to a close earlier.

Adria also has EUR 543,000 on a bank account, but it is kept there to pay a creditor, an issue currently subject to litigation, so it is not included into the bankruptcy estate.

It is not yet know how much exactly Adria owns creditors, since the deadline to report them has been extended until 2 March.

The opening report was also published today by Blaž Poljanšek, the official receiver of company Adria Airways Flight School, which puts the assets of the flight school at EUR 172,000.

The biggest assets are four sport planes, estimated at a total of EUR 109,000.

The flight school, which is eyed by the Pipistrel ultra-light plane manufacturer, also has a licence for training professional and sport pilots.

Creditors of Adria Airways Flight School have reported EUR 448,000 in claims, with Adria Airways being the biggest creditor with some EUR 111,000 in claims.

The state sold Slovenia's flag carrier Adria Airways to Germany's turnaround fund 4K Invest in 2016 for EUR 100,000 after recapitalising it with EUR 3.1 million.

The new owner was unable to give it a fresh impetus, so Adria was grounded last September after almost 60 years since establishment and filed for receivership.

STA, 3 February 2020 - The Slovenian Business Club (SBC) presented on Monday a number of measures which it believes could mitigate the youth brain drain and improve the situation for the young in Slovenia. Politicians have welcomed the initiative, warning that any changes for the better would not occur overnight.

The club's forum, held under the slogan Young are the Future of Enterprising Slovenia, heard that the young were pursuing career paths abroad in the hope of better opportunities. Between 2014 and 2018, almost 11,000 left Slovenia, studies show.

Moreover, housing is in a dire situation, posing another challenge for the young and consequently the future prosperity of country.

The club called for tax as well as business measures, presenting steps which would not only fight the brain drain but also entice young Slovenian immigrants to return to their homeland.

SBC head Marjan Batagelj said that Slovenia did not have an ecosystem which would keep the young or attract them there, pointing out that numerous countries had surpassed Slovenia by providing tax, welfare and housing benefits.

"Slovenia is simply observing while the Balkan pool, on which we like to depend, is getting depleted," said Batagelj.

The proposed measures include tax reliefs, such as untaxed performance bonuses worth up to 200% of the employee's average monthly wage, and ways to reduce taxable income for top experts.

Furthermore, the SBC proposes tax incentives for companies building workforce housing, establishing the right to employability information, introducing business courses in schools and turning Slovenia into a popular destination for foreign experts to fill in the labour shortage.

The forum was attended by senior politicians representing different points on a political spectrum. Addressing the event, President Borut Pahor highlighted the importance of strengthening the institutions of Slovenian statehood in the time of a booming economy.

He added that social dialogue was needed for any structural reforms improving the economic and social situations in the country and making it more attractive for the young.

Education Minister Jernej Pikalo meanwhile said that projects fostering business skills were already present in schools. Moreover, in the past two years, more people with a PhD moved to Slovenia than out of the country, show preliminary data of the Education Ministry.

The Labour Ministry is also working on mitigating the situation, preparing agreements with Turkey and Ukraine which would facilitate attracting foreign workforce.

STA, 3 February 2010 - Car parts maker Hidria announced on Monday that it had developed innovative aluminium steering wheel system casings for next generation hybrid and electric BMW cars, winning a EUR 30 million contract running until 2030.

The casing is a part of a system allowing automatic vertical steering wheel adjustments for individual drivers.

Cars with this system will be available on the European market in three years, Hidria said in a press release, adding that it won the deal in strong international competition.

This deal and contracts for the manufacturing of key components of electric motors totalling to more than EUR 300 million and signed late last year will allow Hidria to develop and strengthen its position in global markets, the company said.

The press release added the company intended to invest more than EUR 50 million in innovation in the coming years and more than EUR 100 million in high-tech production capabilities.

STA, 2 February 2020 - Energy company Gen-I will build the first major solar power plant in North Macedonia. The plant will be built and managed by Gen-I's subsidiary Sonce DOOEL Skopje. Construction is expected to start in early 2021.

North Macedonia will build the 35 Megawatt plant in Amzabegovo and Gen-I will set up panels for 17 Megawatts after winning a public tender.

The Slovenian company has also won the right to use the land for the production of solar power for 50 years, while the state of North Macedonia will provide all the necessary permits, Gen-I said in a press release.

GEN-I Sonce DOOEL Skopje is expected to launch construction at the beginning of 2021 and the power plant should start operating in early 2023. It is to produce 25,000 Megawatt hours of electricity a year.

According to Gen-I management member and CEO of GEN-I Sonce DOOEL Skopje, Igor Koprivnikar, the project is expected to open new opportunities in renewable energy sources production, sustainable energy services and create synergies in financial markets as well as long-term partnerships with investors.

The power plant in Amzabegovo is expected to supply clean electricity to North Macedonia as well as other markets in the region.