The first thing to note is that even the vague shape of the relationship between the UK and EU in 2021, when the transition period that begins at 11pm 31 January 2020 ends, remains unknown, even at this late stage of the game.

The degree of closeness will depend on the degree of alignment – the extent to which the UK continues to follow EU practices, especially in terms of state aid, standards and regulations. In just the last week Sajid Javid, the UK’s Economics Minister (or Chancellor of the Exchequer) said that businesses should get ready for no alignment, a statement that was met with shock by those who understood the implications – a bare bones deal with significant disruption for current UK-EU trade links and no immediate or obvious benefits. A sharp shock to the system. He was then forced to backtrack on his comments, reassuring British businesses – particularly those in the pharmaceutical, automotive and aerospace industries – that close alignment would still be maintained. However, without offering more specifics, or even the outline of what the UK’s negotiating aims are, businesses still have no idea what to plan for.

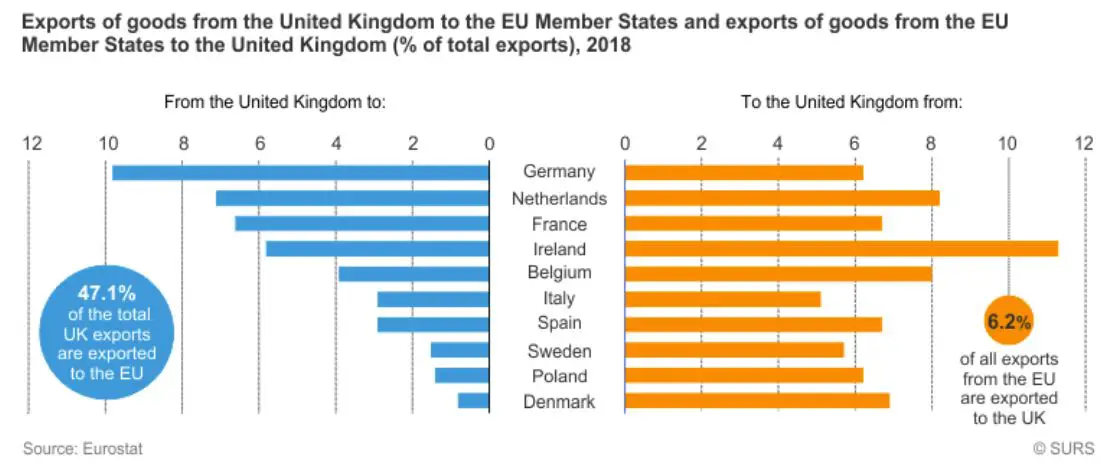

The imbalance of trade. SURS

In truth, no one knows if the UK will be willing to make the compromises needed to maintain a high level of market access, or if it will be possible to sell such a deal to Parliament and the public as “Brexit” – a term that exists in a haze of contradictory aims and positions, its final form a mystery. There’s also the small matter of the EU27 all having to agree on the deal…

Brexit and Slovenia

So there’s a lot that we don’t know, but for a Slovene perspective there’s a report from May 2019, “Analysis of the Consequences of Different Brexit Scenarios on the Internal Market and Trade Relations with the United Kingdom of Great Britain (“Analiza Posledic Različnih Scenarijev Brexit Na Notranji Trg In Trgovinske Odnose Z Združenim Kraljestvom Velike Britanije”), by Dr. Jože P. Damijan Dr. Črt Kostevc, and Dr. Tjaša Redek. It’s in Slovene, but there’s a summary in English that starts on page vii of the PDF.

Trade between the UK and Slovenia

First, the context of British-Slovene trade relations:

In 2018, exports to the UK amounted to €577 million and imports to €441 million (SURS). With a 2% share of total exports, the UK is a modestly important trade partner for Slovenia, whereby its importance is continuously decreasing. In the last two decades, Slovenia’s share of exports to the UK decreased from 3% to 2%. A similar trend can be observed on the imports side, where the share of the UK in total imports decreased form 2% to 1.4% in the last two decades. For Slovenian exporters, the markets of other old EU member states (Austria, France, Italy, Germany) and new EU member states (Croatia, Czech Republic, Hungary, Slovakia, Poland) are more important.

Slovenian exports to the UK are primarily electrical appliances and equipment (19% in total exports to UK), furniture (13%), boilers, machines and mechanical equipment (11%), cars (9%), pharmaceutical products (7%), products made from plastic (7%) and paper and paper products (3%). The main import goods from the UK to Slovenia are: mineral fuels (around 20% of total imports from the UK), electrical appliances and equipment (12%), boilers, machines and mechanical equipment (12%), products made from plastic (5%), pharmaceutical products (4%), steel products (4%) and aluminium products (4%).

Exports of services to the UK amounted to €191 million in 2017 and services imports amounted to €175 million. The main services exports are tourism services, while in imports the main services are business, telecommunications, and IT services.

The UK is a modestly important foreign investor in Slovenia. The stock of foreign direct investment is constant at around €300 million over the last 5 years (2% of total FDI in Slovenia), with the main British investors in Slovenia being PriceWaterhouseCoopers, Unilever, Astrazeneca, Shell and Castrol. Slovenian direct investment in the UK is extremely low – between €15 and €20 million in 2013-2016 and falling to €6 million in 2018. The main Slovenian investors in the UK are Gorenje, Krka, SIJ, Trimo, Bisol, Riko, Savatech and Unior, which mostly mainly invested in trade representative offices in the UK to promote their exports.

Hard or soft Brexit?

The study then goes on to examine the impacts of three scenarios on Slovenia : hard Brexit (no deal at the end of 2020, and the UK trading on WTO terms), deferred hard Brexit (the same, but with a longer transition period that the current 11 months), and soft Brexit, envisaged here as being similar to EFTA membership, with a high level of market access, although still below the current one. As noted at the start of this story, any of these three remain possible – along with various different flavours of soft Brexit, but the present rhetoric from London seems to be pushing for a relatively hard Brexit. That said, London talked strong in 2019 but then signed up to a Withdrawal Agreement that puts a border in the Irish Sea, so as the pressure mounts anything could happen.

The impact of Brexit on exports, imports and employment in Slovenia

The paper presents a thorough analysis of the three scenarios, with the key paragraphs presented below:

According to model simulations, a composite effect of Brexit on Slovenian exports will be in a range between a 0.06% reduction (hard Brexit) and 0.01% increase (soft Brexit). This composite effect consists of a potential reduction of Slovenian exports to the UK in the range between 3.7% (soft Brexit) and 32.3% (hard Brexit) and an increase of exports to other EU countries and the rest of the world. Hence, due to trade diversion effects, a reduction in exports to UK after Brexit would be almost entirely compensated by increased exports to other EU countries and rest of the world.

The sectoral overview shows that due to hard Brexit wood processing and furniture, public services, paper products, forestry, production of metal products and production of crops might be hurt the most, though the estimated effects are quite low. In the case of hard Brexit, gross value added in wood processing and furniture might drop by 1.1% in 10 years and by a quarter of 1% in the case of an orderly Brexit. Effects of a similar magnitude are expected also in the paper processing industry, while in other industries that will be hurt by Brexit the estimated effects do not exceed 0.3% cumulatively in 10 years. There are, however, also industries that might benefit from Brexit, in particular the car industry, chemicals, meat processing and leather industry (a rise between 0.3% and 0.9%), while for other industries these effects will not exceed 0.1% in the 10-year period.

The potential aggregate impact of Brexit on employment is estimated to be relatively low. Our calculations show that about 237 jobs (soft Brexit) and up to 900 jobs (hard Brexit) might be at risk. Most of these jobs that are at risk are in the services industries and for qualified labor. However, these employment effects due to Brexit are lower by the factor of 5 when compared to regular seasonal fluctuations in the labour market.

You can see more of the report, which goes on to a summary of corporate and consumer sentiment with regard to Brexit, here. All our stories on Brexit and Slovenia are here.