Ljubljana related

The 2019 Real Estate Market Report, published by the Surveying and Mapping Authority of the Republic of Slovenia, shows that property prices continued to grow last year.

In 2019 the prices of apartments across the country broke the previous record set in 2008. In Ljubljana, however, the record was already broken in 2018.

The national average for a square metre of an apartment was €1,850 in 2019, 2% higher than the national average in 2008.

Since 2015, housing prices have risen steadily. The highest price growth was recorded in 2018, when the prices of second-hand flats were, on average, 9% higher than in the previous year, despite the decrease in the number of sales. In 2019 housing price growth continued at a slightly lower rate.

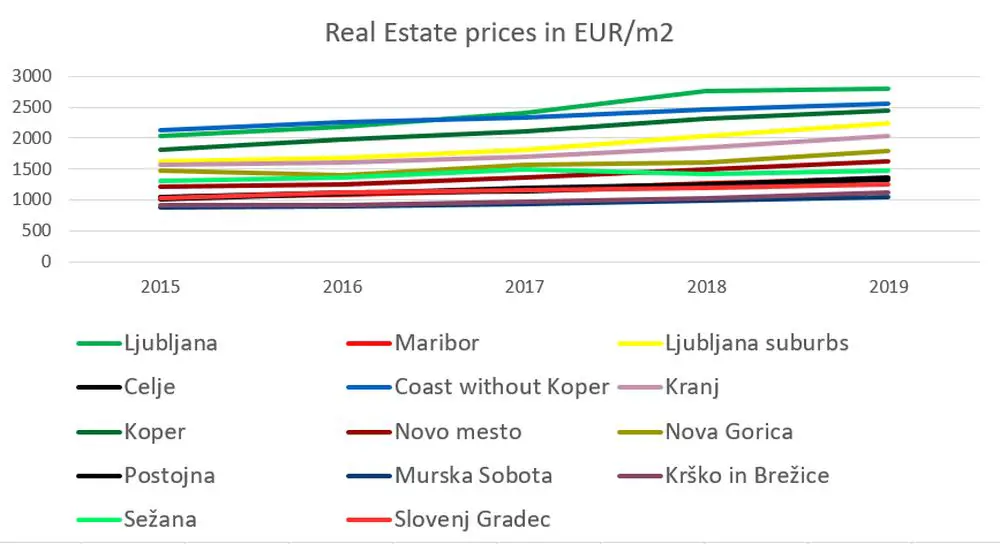

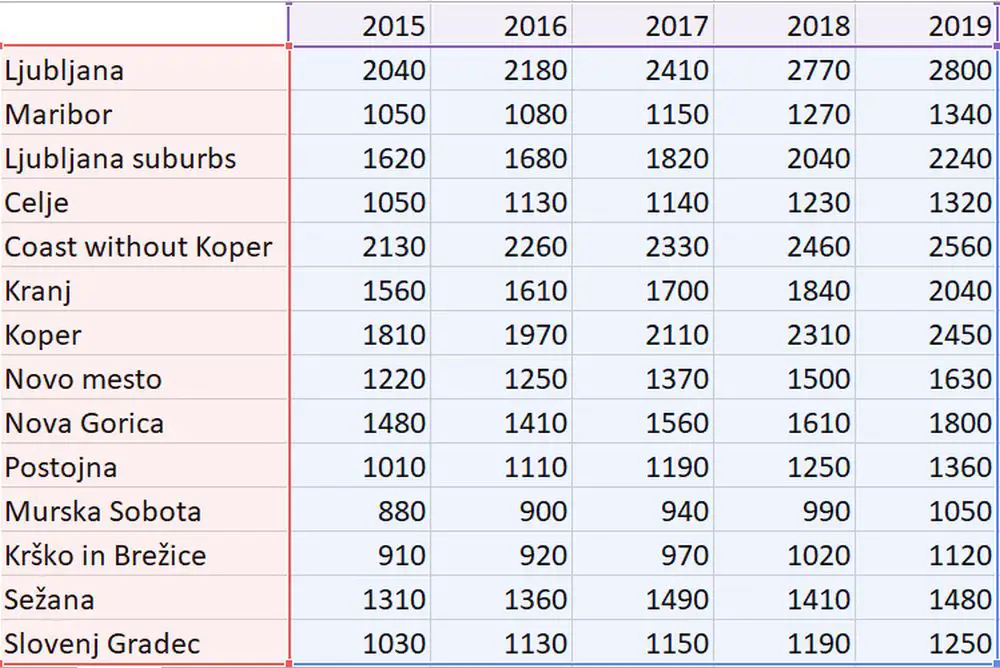

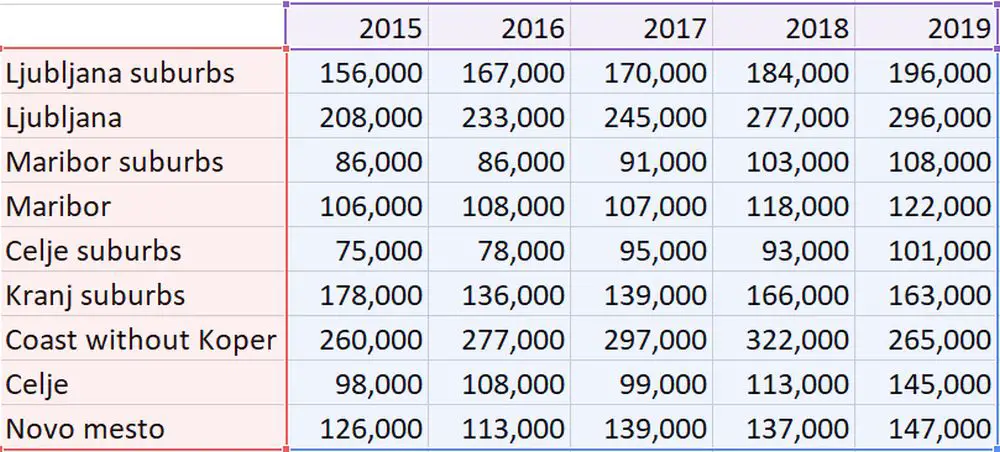

Apartment price averages in euros per square meter:

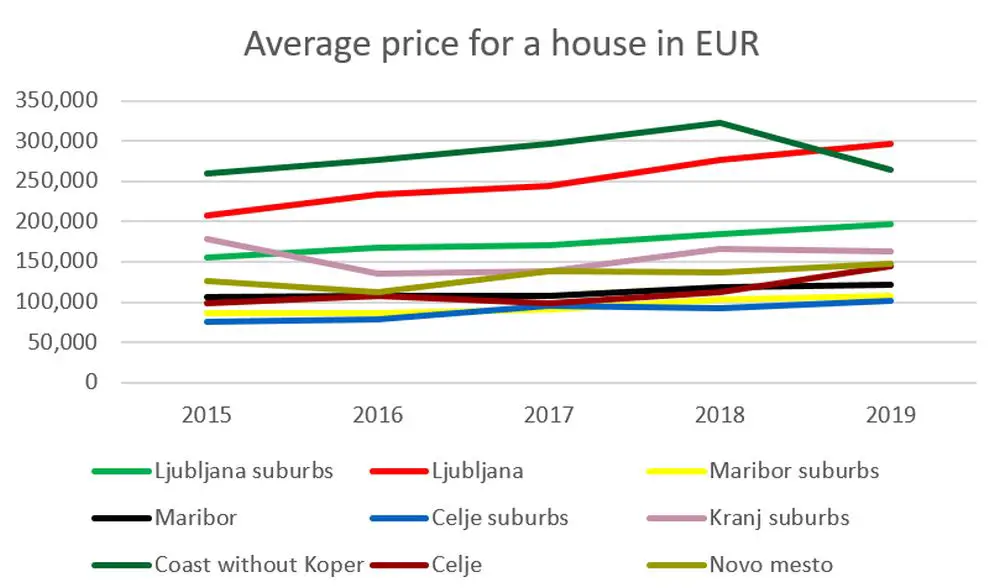

The average price of a residential house with land belonging to it in Slovenia was EUR 128,000 in 2019, 3% higher than in the previous year and 19% higher than in 2015. Since 2015 the average area of homes sold has increased significantly, while their average age and the area of land they come with have not changed significantly. Taking into account the characteristics of the houses sold, it has been estimated that house prices at the national level have grown by 15 to 20% in real terms since 2015, while compared to 2018 they have remained virtually unchanged.

Average price for a house in EUR:

You can’t travel now, early May 2020, but you can still dream about it, and make plans. So why not take a look at a large, luxurious vacation rental in the discreet and well-connected central Ljubljana neighbourhood of Prule. The area’s home to embassies, architects and artists, charming cafés, restaurants and bars, with the peace of the riverside and just a few minutes’ walk – or faster cycle – to the Old Town and then Castle, with it’s commanding views of the city and off into the mountains.

Inside the apartment you can enjoy all the amenities you’d expect from a luxury rental, with everything you need to feel at home – in clean, stylish and bright surroundings, with an eye for design that makes the most of the space and it’s light.

Along with the location, size and design, one of the most striking aspects of the apartment is the atrium and terrace, which at 137m2 is larger than many apartments in the city – the ideal spot to relax in privacy before or after your adventures outside.

The three bedrooms include a master with en suite bathroom and its own doors to the terrace. A second room has a king-size bed, and a third two single beds that can be joined together.

In addition to the en suite bathroom there’s a large family bathroom

A full kitchen means it’s easy to make the most of your stay in Ljubljana by visiting the central market, or a nearby supermarket, and stocking up on local specialities and vacation essentials. You’ll be able to get everything you need to enjoy a relaxed meal or drink in the garden, or inside at a dining table that seats six.

If you’re passing through Ljubljana for a few days between other locations, then the washing machine and dryer make this rental a great place to sort out your luggage and stay clean and refreshed on your trip. The apartment also has plenty of storage space, so if you’re staying longer – and Villa Prule is available as a short- and mid-term rental – you can keep your things organised while the housekeeping service keeps it clean.

The apartment is currently on available for from €125 a night. If you’d like to see more of Villa Prule, or other fine apartments in Ljubljana, then visit Fine Ljubljana Apartments and you’ll soon find your ideal home in the city.

STA, 20 March 2020 - With tourism grinding to a halt as the country fights the coronavirus outbreak, Slovenia could learn some lessons regarding housing policy, including that the market should not be trusted just about everything, Dnevnik says in Friday's commentary.

The commentary notes that people who lease their apartments via Airbnb have quickly realised that they will have no turnover whatsoever as tourist visits to Ljubljana steeply dropped with the arrival of coronavirus.

They have started advertising one- to two-month leases, and then also for longer periods, but of course, in the time of quarantine and self-isolation, this did not help either.

Real estate agencies are closed, people are locked in at home and no one is looking for an apartment if this is not really necessary. Completely unrealistic expectations of owners are another problem.

No one knows when the situation will normalise, and when it does, much time will need to pass before tourists fill up Ljubljana again, Dnevnik adds in Airbnb Apartments Are Now Good for Locals.

As for many people renting apartments to tourists is the principal activity, and not only a side business, these individuals, as well as many others in the tourism and hospitality industry, are in a difficult situation.

It seems that a majority of people feel no empathy towards real estate owners who earned money via Airbnb, and there are even calls that they should show their social responsibility by renting out their empty apartments to medical staff for free.

"The people's reaction is understandable, but it would be wrong to succumb to anger at this moment. Reason tells us that if we learned something from this crisis, it is that not all bets should be placed on the market."

For this reason, the state needs to regulate apartment renting via Airbnb, create conditions for an orderly rental market, and build public rental apartments as a priority. This would be a precious measure during the recovery period.

All our stories on coronavirus and Slovenia are here

STA, 21 January 2020 - Bank NLB has asked the Constitutional Court to review tighter restrictions on lending imposed by the central bank in November. After filing the request on Tuesday, the bank expressed belief that its request would be a matter of priority for the court because of the "radical effect" the measures had on the quality of Slovenians' lives.

The bank believes that the measures were introduced too hastily and were too radical, and that they have to be abolished. Any anomalies detected in "individual market players" should instead be addressed with targeted and not systemic measures.

NLB says Banka Slovenije imposed the measures virtually overnight and triggered "an excessive drop in volume of loans and accessibility of loans by Slovenians within the strictly regulated and controlled system of commercial and savings banks, whereas there are no restrictions imposed on more expensive and more risky third loan providers".

The bank argues that the measures have already produced a radical effect with virtually total stop in growth in loan volume. What is more, the number of loans given out in the recent months has dropped dramatically.

The restrictions were introduced to protect the taxpayer, says the bank, adding, however, that Slovenian population is already among the least indebted in relevant global comparisons, while banks are highly liquid, which means that they are capable of absorbing any potential major shocks.

Moreover, Slovenia has the fresh experience of an extremely tough crisis, but in the 2009-2015 period there was no excessive increase in default among the population, the bank said.

Saying the measures were introduced overnight, the bank says the "legal unpredictability" makes it extremely hard to make business plans and evaluate companies.

The move by NLB comes a day after the Bank Association released data showing that the number of consumer loans had dropped by 60% compared to October and housing loans by 40%.

STA, 20 January - Data from the Slovenian Bank Association show that the number of loans approved by banks in Slovenia in November and December, after the central bank's new crediting restrictions kicked in on 1 November, plummeted.

Data from ten banks show that the number of consumer loans dropped by around 60% over October and the number of housing loans by around 40%.

The number of consumer loans totalled 10,015 in October, but decreased to 3,804 in November and 3,624 in December, whereas the number of housing loans dropped from 1,424 in October to 923 in November and 812 in December.

The new rules took effect after Banka Slovenije announced them on 9 October in a bid to curb imprudent consumer lending practices.

The association noted that Banka Slovenije data also showed a steep drop in both types of loans after a major rise in October.

It added the surge was most probably a result of the central bank's announcement of the new rules, which prompted many to take out loans while still creditworthy.

The restrictions include a maximum 84-month maturity for consumer loans, down from 120 months recommended in 2018, and, most notably, curbs on housing loans.

Banks for the most part have to keep loan-to-value ratios (loan payments relative to the client's annual income) to below 50% for clients with monthly income of up to twice the gross minimum wage and below 67% for those making more than that.

Households with children are subject to additional restrictions since a certain monthly allowance needs to be left over for each child.

After the announcement of the new rules, the association estimated over 300,000 individuals would no longer be creditworthy.

Earlier this month the central bank said it was too early to fully assess the effect of the stricter rules.

Ever wondered where all the second homes are in Slovenia, the vikendi and those defined by the Statistical Office of the Republic of Slovenia (Statistični urad Republike Slovenije – SURS) as “dwellings reserved for seasonal and secondary use”? If so, wonder no more as we zoom in the data for 2018, the most recent year for which it’s available.

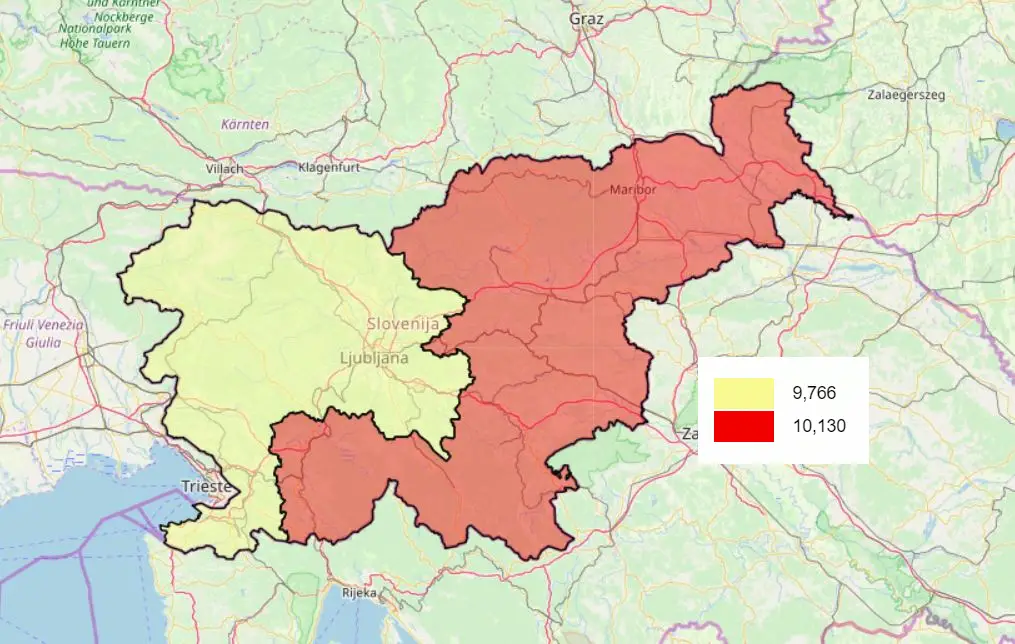

According to SURS, in 2018 there were a total of 19,896 such dwellings in Slovenia. Of these, 9,766 (49%) were in the west, and 10,130 (51%) in the east.

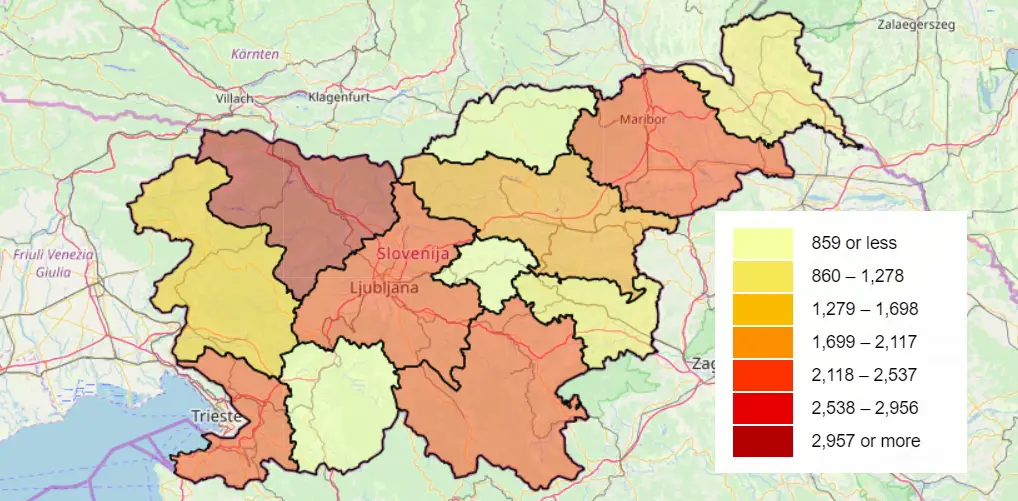

But that scale, the two “cohesion regions”, hides a lot of detail, and if we look at the 12 statistical regions then something become clear: that Gorenjska (AKA Upper Carniola) seems to be the most desired location, with 3,376 holiday homes, or just under 17% of the total, as seen in the following map and table.

| Slovene | English | # | % |

| Gorenjska | Upper Carniola | 3,376 | 5.22 |

| Osrednjeslovenska | Central Slovenia | 2,489 | 12.51 |

| Obalno-Kraška | Coastal–Karst | 2,333 | 11.73 |

| Jugovzhodna Slovenija | Southeast Slovenia | 2,324 | 11.68 |

| Podravska | Drava | 2,168 | 10.90 |

| Savinjska | Savinja | 2,078 | 10.44 |

| Goriška | Gorizia | 1,568 | 7.88 |

| Posavska | Lower Sava | 1,037 | 5.21 |

| Pomurksa | Mura | 988 | 4.97 |

| Koroška | Carinthia | 650 | 3.27 |

| Zasavska | Central Sava | 446 | 2.24 |

| Primorsko-Notranjska | Littoral–Inner Carniola | 439 | 2.21 |

And the most popular place to buy a holiday home in Slovenia is...

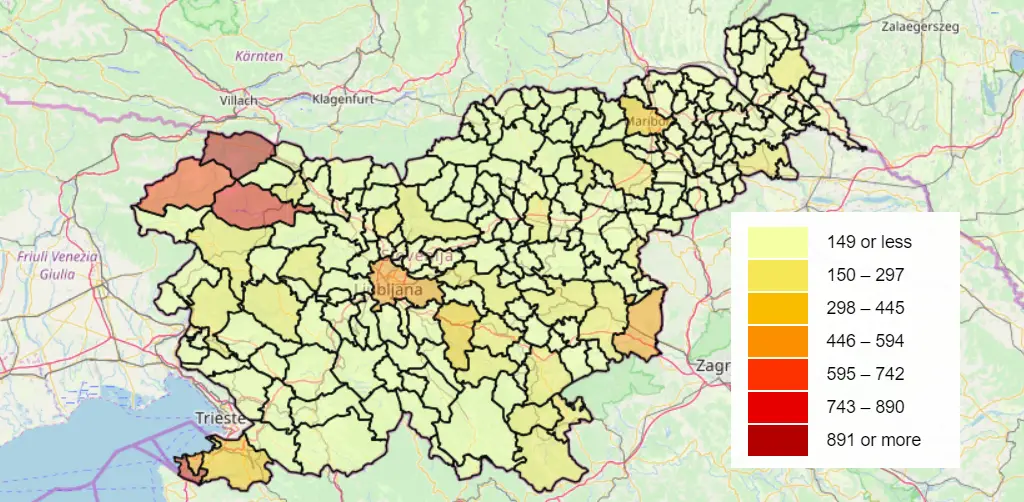

Now zooming in to the highest level of detail that SURS offers – the 212 municipalities – we can see that there are seven areas where there are more than 500 holiday homes: Piran (1,038), Kranjska gora (961), Bohinj (843), Bovec (608), Brežice (526), Ljubljana (523), and Izola (512). You can visit an internactive version of the map below here and learn more, if wanted, while if you’re interested in more statistics about Slovenia then all our related stories are here.

If you’re curious about some of the homes on the market, then check our real estate section, while all our stories on property are here.

STA, 12 December 2019 - The Finance Ministry has drawn up a blueprint for a law introducing government guarantees for housing loans. These would be fully guaranteed up to EUR 150,000 in principal provided the borrower provides 20% in the form of own funds.

Unveiling the proposal in Ljubljana on Thursday, Finance Ministry State Secretary Alojz Stana said the scheme was aimed at the young up to the age of 35, young families and those in fixed-term or precarious forms of employment not older than 40.

A 100% guarantee would be available for housing loans amounting to up to EUR 150,000 in principal with a maturity of up to 30 years, rescheduling included.

The borrower would have to chip in at least 20% in the form of own funds, which is in line with loan requirements of the central bank, Banka Slovenije.

The total amount of guarantees is planned at up to EUR 500 million in principal. The annual amount of funds would be determined in the state budget implementation acts.

The borrower would be able to pick the bank they take the loan from, while the guarantor would be able to pay up to six past due instalments to the bank instead of the borrower.

This option would be available to the borrower several times while the loan was active, but only under condition that liabilities from the recourse claim were settled.

If the guarantee was enforced, the state's recourse claim would be repaid from the proceeds from the sale of the property with the national Housing Fund having the pre-emptive right to buy.

Unofficial information indicates that the ministry is still looking for a solution how to enable the borrower who was unable to repay the loan to stay in the property.

One option would be non-profit rental, but there would be a scope for abuse.

The ministry says that the scheme is aimed at creditworthy borrowers, so it does not interfere with the central bank's tightening of criteria for consumer loans.

However, the ministry hopes that Banka Slovenije may reconsider the consumer lending brake because of the state guarantee scheme.

The ministry expects that the lending terms for state-guaranteed loans would be easier on the borrowers. It hopes that the scheme's impact on property prices would not be excessive.

The scheme would be implemented by the state-run export and development bank SID. Guarantees would be issued for loans hired until the end of 2030.

The blueprint has been agreed with the Ministry of the Environment and Spatial Planning and is expected to be submitted for public consultation in January.

The scheme would be just one of housing policy measures with the main objective being increasing the fund of rental housing. Housing policy measures are to be updated in a new housing loan that is in the pipeline.

Following the central bank restrictions on consumer lending, a state loan guarantee scheme has been proposed by the opposition Democrats (SDS), but the corresponding bill was voted down in parliament.

STA, 24 October 2019 - After three years of steep growth, real estate prices started to show signs of stagnation in the first half of 2019. Prices of flats are very close to the record figures seen in 2008, while prices of houses are lagging behind significantly, show data from the Mapping and Surveying Authority.

The average price for a second-hand flat in Slovenia in the first half of 2019 was EUR 1,810 per square metre, which was 1.7% more than in the second half of 2018.

Prices of flats have been growing fast since 2015, when a downward trend finally reverted after the 2008 economic and financial crisis.

Alone in the first half of 2018 the average price for a second-hand apartment increased by nearly 7%, the Mapping and Surveying Authority noted on Thursday.

But the second half of 2018 and the first half of 2019 saw the growth in prices slowing down to 2%, above all due to stagnation of prices in Ljubljana.

The average price for a second-hand apartment in Ljubljana was at EUR 2,780 per square metre between January and June, which was about 0.5% more than in the second half of 2018. The authority says that prices have stagnated in Ljubljana since the beginning of 2018.

Property prices still rising faster on the coast

A different trend was recorded on the coast, where prices of used flats are growing increasingly fast.

Average price for a second-hand flat on the coast, excluding the town of Koper, was at EUR 2,640, over 7% more than in the second half of 2018. This was also the highest growth rate recorded on the coast since 2015.

Data for Koper show that average price of second-hand apartments was at EUR 2,440, 4% more than in the second half of 2018. Prices of second-hand flats around Ljubljana were at EUR 2,180 (up 5%) and in Kranj they were at EUR 2.060 (up 7%).

Prices of houses have also been growing since 2015, albeit slower than prices of flats. Just like in flats, the biggest increase in prices was recorded in the first half of 2018 and growth of prices started slowing down at the beginning of 2019.

In the first half of the year, the average house sold in Slovenia was 169 square metres big, located on an average plot of 910 square metres, with an average price of EUR 127,000.

This compares to an average price of EUR 128,000 for an average house of 162 square metres located on an average plot of 980 square metres sold in the first half of 2018 and to an average of EUR 120,000 for an average house of 163 square metre on a 890 square metre plot sold in the second half of 2018.

In the first half of the year, prices of houses were highest in Ljubljana, costing EUR 286,000 on average, on the coast (excluding Koper) the average price for a house was EUR 264,000, while houses around Ljubljana cost EUR 193,000 on average.

Construction plots cost EUR 56 on average per square metre, which was about 10% less than in the second half of 2018 and some 3% less than in the first half of 2018.

The number of transactions in the first half of the year reached 17,100, which was 2% more than in the second half of 2018. Deals totalled to EUR 1.33 billion, up 11% over the second half of 2018.

Housing property accounted for 54% of all transactions. Transactions with flats amounted to EUR 432 million or 32% of total transactions, while sales of houses amounted to a total of EUR 290 million or 22% of the total transaction value.

STA, 14 October 2019 - The Environment and Spatial Planning Ministry presented a new housing bill proposal on Monday. The document aims to make housing more accessible to those in precarious jobs, young families and the poor, as well secure more effective management of apartment blocks. It also makes it harder for owners to rent out their apartment through Airbnb.

The bill abolishes non-profit rent and replaces it with what it calls a cost rent, which would amount to up to 5.2% of the cost price of a new apartment.

Depending on location, the cost rent would stand between EUR 5 and EUR 7.30 per square metre, Environment and Spatial Planning Minister Simon Zajc and state secretary at the ministry Aleš Prijon told the press.

Under the new system, those renting out apartments are to make more in rent, however nothing is to change for those renting the apartments, as the difference in rent will be covered by a housing allowance.

This will bring in more money to the national Housing Fund and municipal housing funds, which is to be used for maintenance and construction of new apartments.

Eligibility of renters is to be checked annually, which has not been the case in the past. If the renter will exceed the income limit, they would be able to remain in the apartment but would have to pay a higher rent, up to 1.5 times as high as the cost rent.

Last year, municipalities spent EUR 12.4 million for housing subsidies, while the state contributed EUR 3.8 million.

Under the new system, municipalities will contribute EUR 12.3 million for the housing allowance, while the state is to provide EUR 28.5 million.

Moreover, the national Housing Fund is to establish a rent-out service, a kind of national real estate agency that would facilitate the renting out of empty apartments.

The public service will pay rent, find a renter and make sure that the apartment is returned to the owner in the state it was in before it was rented out, said Prijon.

The ministry expects that this would put between 20,000 and 30,000 apartments on the market, out of 170,000 apartments that are officially empty.

The bill also introduces state guarantees for the young and young families, who are unable to acquire a housing loan with banks.

In case that the loan-taker would no longer be able to pay off the loan, the Housing Fund would become the owner of the apartment, however, the loan-taker would still be able to live in the apartment and pay cost rent.

Moreover, the bill will increase the municipal funds' borrowing limit from 10% of its capital to 50%.

It also changes multi-dwelling management rules, for instance making it easier for residents to change the apartment block management firm.

New restrictions on Airbnb

Also, those who will want to let out their apartments through platforms such as Airbnb, thus changing the intended function of their flat from private to commercial, will have to get the approval of all apartment owners in their building, said Prijon.

The bill also lays out the conditions for housing cooperatives. The Housing Fund would likely contribute plots, while members of the cooperatives would each contribute a part of the cost of construction.

The rest of the funds needed would come from loans taken out with a guarantee from the Housing Fund. Members, who would want to withdraw from the cooperative, would get their contributions returned.

STA, 3 October 2019 - The government confirmed on Thursday a package of tax tweaks that are meant to reduce taxes on labour to increase competitiveness. The list includes increased general tax credit and changes to the income tax brackets to reduce the tax burden on the middle class. On the other hand, the taxation of capital gains and rental income is to rise slightly.

The changes, which the government wants passed in fast-track procedure so they can enter into force with the start of 2020, affect laws on personal income tax, corporate income tax and on tax on profit from disposal of derivatives.

Speaking of a "new step towards tax optimisation", the government said that the "proposed measure will additionally reduce the burdens on labour, whereby we are strengthening competitiveness, preserving a stable economy and contributing to sustainable economic growth".

In general, the changes are designed to increase take-home pay, which will be achieved with a higher general tax credit that all taxpayers are entitled to, by EUR 200 to EUR 3,500.

In an effort to reduce the tax burden on the middle class, the tax rate will fall by one percentage point both in the second and third brackets, to 26% and 33%, respectively.