STA, 24 October 2019 - Slovenian households stepped up saving in 2018, recording a gross household saving rate of 12.6%, up 0.2 percentage points on 2017. The country's gross rate, which shows what share of household disposable income is saved, was one of the highest in Europe, shows the Statistics Office data released on Thursday.

"The saving rate was increasing in the recent years, but it's still lower than it was before the financial crisis," said the office's deputy head Karmen Hren ahead of World Savings Day, observed on 30 October.

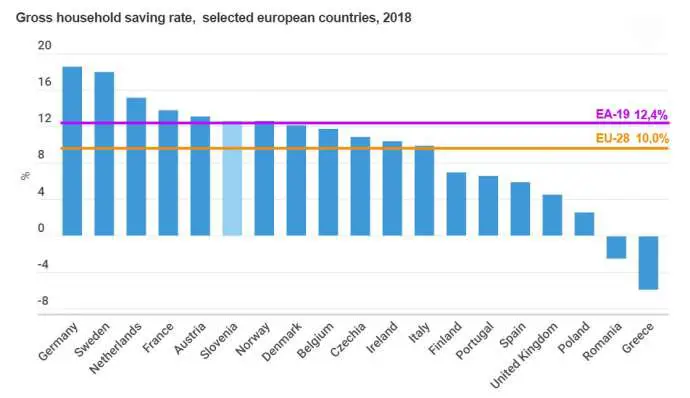

For the second consecutive year, the rate was higher than the average rates in EU-28 and EA-19 member states - 10% or 12.4%, respectively.

According to the latest Eurostat data on average saving rates, Slovenian households share the sixth place with Norway in Europe.

The highest rate was recorded in Germany (18.5%), while the lowest was found in Greece (-5.9%).

Slovenians mostly save up for their autumn years, children or grandchildren support, holidays and emergency cash reserves or to buy a flat, said Hren.

Despite low interest rates on deposits, Slovenian households still mainly opt for a typical form of saving - bank deposits. Their share has decreased slightly though.

Cash and deposits (47.7%) stood out in the structure of household financial assets, followed by shares and other equity (30.2%) and insurance and pension schemes (13.8%).

Households have EUR 120 billion in property assets and EUR 53 billion in cash.

Related: Household Disposable Income Rose 5.5% in 2018, Highest in Koroška, Lowest in Pomurje

In 2018, the majority of household liabilities (87.1%) represented loans. Some 80% of those were long-term loans.

In 2014, the loans started to grow gradually, and in 2018 they were up 6.5% compared to the previous year. The consumer loans (up 11.3% in 2018) have been growing at a much faster pace than housing loans (up 4.4%) in particular in the past two years due to favourable economic conditions.

Some 20% of Slovenian households estimated in October that their financial state was good or even very good, which is quite an increase compared to 2015 when the share of such households was 7%. Some 20% also believe that the situation will further improve in the next year, said Hren.

More details on this data can be found here, while more statistics can be found here