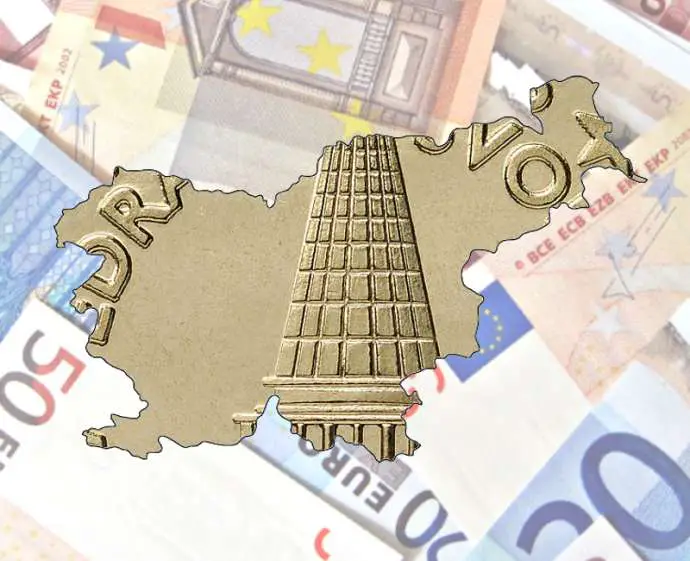

STA, 5 August 2019 - Slovenia's 10-year bonds have recently traded at sub-zero rates on the secondary market for the first time ever, whereas the country had a hard time selling its bonds at a 7% rate during the financial crisis in 2013.

The yield on Slovenia's 10-year bond dropped below zero on Friday, dropping further to minus 0.06% today, the business daily Finance reported, quoting Bloomberg.

The drop to the negative territory is part of a broader trend of falling yields for euro-denominated state bonds witnessed over the past days.

It comes after the European Central Bank said it would further ease its monetary policy and amid raised uncertainties in the European and world economies, while investors are looking for returns elsewhere.

According to the MTS Bonds.com platform, the 10-year bond issued on 14 March and further expanded on 8 July trades at minus 0.01%.

When Slovenia secured another EUR 350 million in July to expand the original 10-year bond issue, which is due in March 2029, the bond had a yield of 0.157%.

If investors buy it on the secondary market now, they find it acceptable to get a lower return then they would pay for it today.

Nevertheless, this does not necessarily mean that a newly issued Slovenian long-term bond would also have a negative rate.

While sub-zero rates are new for Slovenia's long-term debt, its short-term bonds have traded at sub-zero yields for several years.