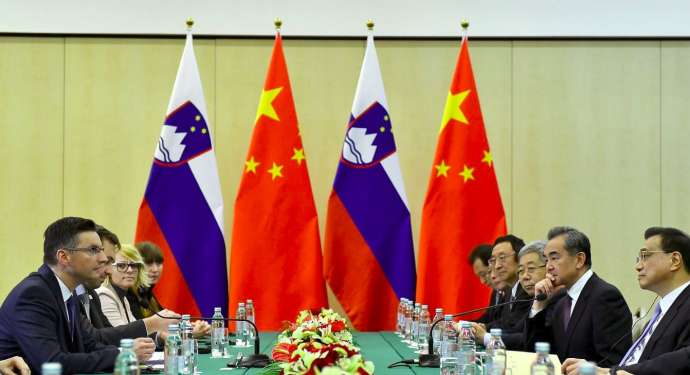

STA, 12 April 2019 - Prime Minister Marjan Šarec highlighted the port of Koper as the closest link between Central and East Europe, and China as he addressed the eighth summit of China and 16 Central and East European countries in Croatia's Dubrovnik on Friday.

In line with the bill, courts will have to weigh whether Banka Slovenije, the central bank, correctly applied the law in ordering the bailout, and correctly estimated bank losses.

Plaintiffs will be able to launch proceedings within ten months after the law enters into force. Banka Slovenije will be the defendant and if it loses, it will have to settle the damages from its reserves. If those do not suffice, it will be able to borrow from the state.

Banka Slovenije opposes the bill, in particular the solution under which it would have to pay damages if the courts establish to the plaintiffs were wronged, arguing that this would lead to unlawful monetary financing.

The central bank believes the law should state clearly that it is not responsible to pay compensation for the damage. A similar position is held by the European Central Bank.

The government rushed to endorse the bill at yesterday's correspondence session because the upper chamber of parliament, the National Council, was also preparing a similar bill, which however envisages the state launching procedures against Banka Slovenije.

"We rushed it, because we wanted the legislative procedure to start as soon as possible. It is possible that we will be merging the bill with the National Council's legislative proposal," Finance Ministry State Secretary Metod Dragonja said yesterday.

The National Council adopted its proposal today, arguing the government's bill fell short of what had been asked by the Constitutional Court.

The upper chamber's president Alojz Kovšca stressed that excessive procedural costs would discourage potential plaintiffs from suing Banka Slovenije, which means effective legal protection had not been provided.

The National Council would have Banka Slovenije sued by the state and the burden of proof transferred to the central bank.

Kovšca announced cooperation in the adoption of the final act, but added it would be vetoed if it failed to provide a realistic solution.

The bill will go through a regular procedure in parliament and the government is counting on it to be passed in June or July.

In the three months after the passage, special virtual data rooms envisaged by the bill would be set up by the Securities Market Agency (ATVP) where Banka Slovenije will give all interested parties access to information.

Potential damages are estimated between zero and EUR 963.2m, which is how much liabilities were wiped out by the banks which were nationalised in 2013 and 2014, plus extra costs.

The Finance Ministry said in presenting the bill that Banka Slovenije had decided for the measures independently and therefore carried the responsibility and liability for potential damages.

The legislation based on which the measures were taken has been found to be in line with the Constitution, so it is Banka Slovenije and not the state which is responsible for the way the legislation was implemented, the ministry said.

The ministry took into account the central bank's remarks regarding the setting up of data rooms, which it claimed would be too expensive, so the bill envisages the setting up of virtual rooms by the ATVP with the ministry only providing one room where computers and software will be available for accessing data.

But the ATVP warned in a letter today that it lacked the necessary know-how, money and staff to set up the virtual data rooms, so it would have to outsource them, which would require additional funding and a lot more time than the envisaged three months.

The agency also said it had no resources to decide on the potential thousands of applications for access to the data rooms, so it proposes that Banka Slovenije or the Public Administration Ministry take over the task.

In line with the bill, the court will decide whether there are grounds to award damages to plaintiffs and also set the amount of the potential damages, whereas in the original proposal Banka Slovenije was to determine the amount of damages, pending final approval by the court.

All procedures will be handled by the Maribor District Court, where Banka Slovenije will have to prove that it had reasons for the wipe-out and that it takes into account remarks regarding access to information and data protection.

Slovenia spent roughly EUR 5.5bn bailing out and nationalising the three largest banks in the country (two small banks were wound down) in a process seen as saving the economy from ruin.

However, subsequent revelations cast doubt on the methods used to value bank assets, which in turn determined how much capital banks needed and to what extent junior creditors were affected.

All our stories about Slovenia and China are here