May 11, 2018

In this article we will make a short overview of the social contributions and income tax payments one should expect if opening an SP (sole proprietor) business in Slovenia, often referred to as self-employment.

There are two ways in which the tax basis (davčna osnova) can be estimated, depending on the type of SP one chooses upon registration at business register (AJPES). The first one is the ordinary type of SP, in which actual expenses are counted and subtracted from the gross income. Any profits are then taxed according to the rate for each particular income bracket, and general and particular tax credits can be applied.

The other one, called normiran SP (normative SP, from here on nSP), is much simpler in terms of book-keeping, as the tax basis is simply calculated at a fixed 80% rate of expenses and a 20% final tax you then pay on the remaining 20%, which counts as your profit. In other words, you will pay 20% on 20%, that is 4% tax on your entire income, no matter how low it might be, although the upper limit for an nSP is 50,000 EUR (annual), which is also the figure at which you become liable for value added tax (VAT, or davek na dodano vrednost, DDV, in Slovene).

It is often suggested that people with high expenses should opt for ordinary SP, while those with low expenses who mostly sell their services should opt for the nSP.

Furthermore, due to the fixed expense rate (80%) and fixed and final tax rate (4%), an nSP is also much easier when it comes to accounting, which is going to be the scope of this article. With some idea on the basics, an nSP can avoid nasty surprises when new calculations of their social security and tax bills land in their mail box after an usually successful business year.

Personal Income Tax for an nSP

As already mentioned, taxes are easy to compute for an nSP. There is a final 20% tax on profits from your services. As the rate of expenses are always set at 80%, income tax always applies to the remaining 20%. Since 20% of 20% is 4%, you can easily apply the 4% rate to your entire gross income and that’s it. No additional tax, but also no tax credit.

Social contributions

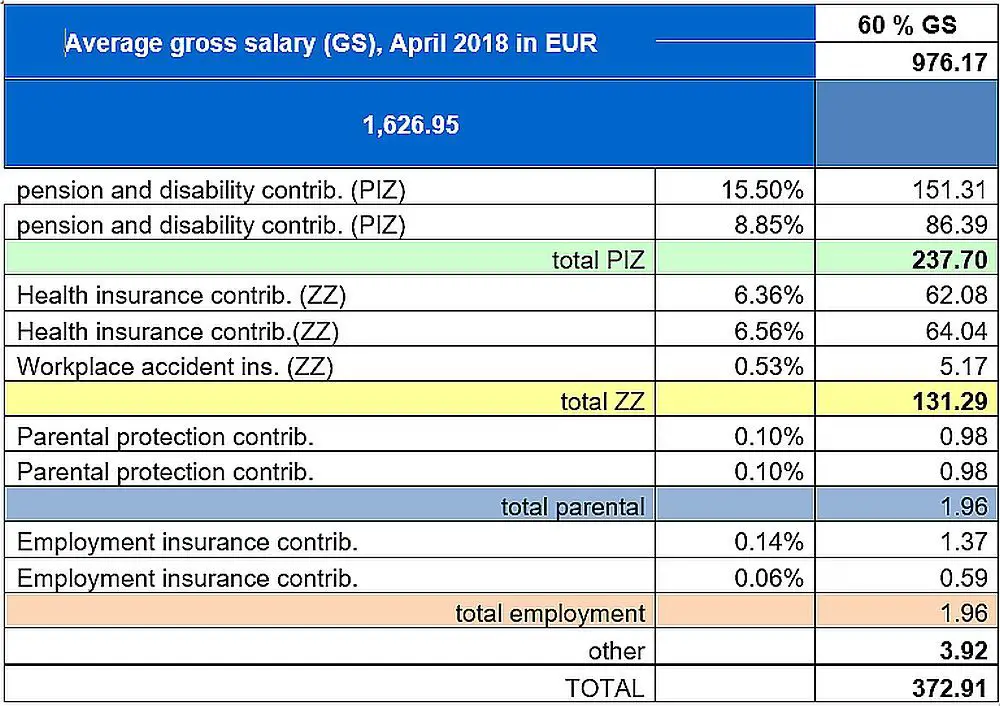

Social contributions consist of mandatory insurance policies that are usually divided between an employee and his employer, and are therefore covered entirely by a self-employed person on a monthly basis. These four contributions are:

- pension and disability insurance contributions (prispevki za pokojninsko in invalidsko zavarovanje): 15.50% (employee) + 8.85% (employer) = 24.35 % (SP)

- health insurance contributions (prispevki za zdravstveno zavarovanje): 6.36% (employee) + 6,56% (employer) + 0,53% (workplace acc. insur.) = 13,45% (SP)

- parental protection contributions (prispevki za starševsko varstvo): 0.10% (employee) + 0.10% (employer) = 0.20% (SP)

- employment insurance contribution (prispevki za zaposlovanje): 0.14% (employee) + 0.06% (employer) = 0.20% (SP)

All these percentage rates refer to your insurance base, so how is this measured?

Determining the insurance base and the initial discounts

Your insurance base is determined by your previous year’s profits and social contributions. If you have just registered your SP then the minimum social contributions which stand at 60% of the average national salary will apply:

Furthermore, first time business registers are eligible to the partial exemption from the payment of contributions for pension and disability insurance (PIZ). That is, a person who already had registered an SP account and subsequently closed it, is not eligible for this (PIZ contributions only) discount, which amounts to 50% in the first year and 30% in the second. Minimum social contributions in this case amount to 254.05 EUR in the first and 301.60 in the year that follows.

After the initial year, however, contributions will be calculated according to the sum of your taxable income and contributions payed in the previous year and if monthly average of that won’t exceed 60% of the average gross salary in Slovenia, you will continue to pay minimum contributions (and get the minimum pension out of it, once retired) if not, your contributions will be adjusted accordingly.

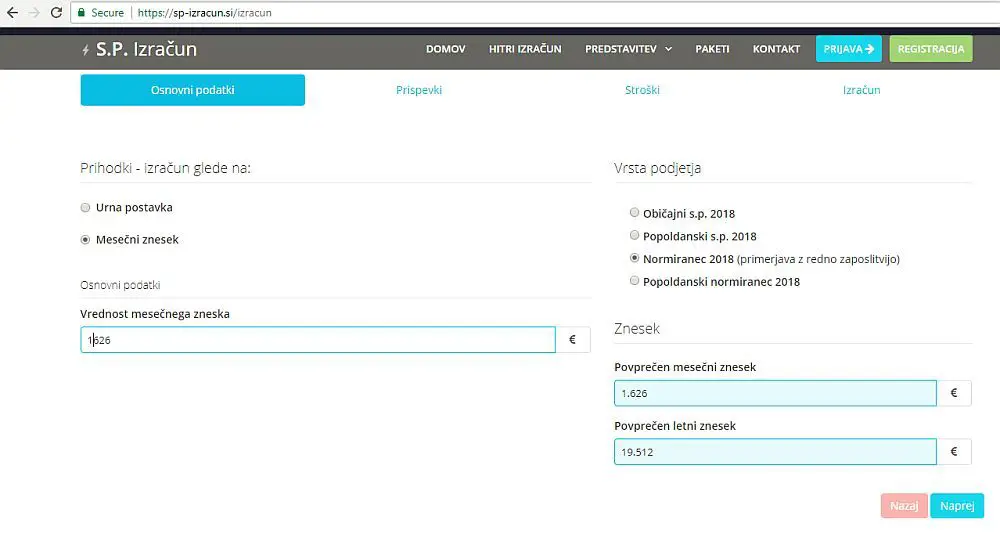

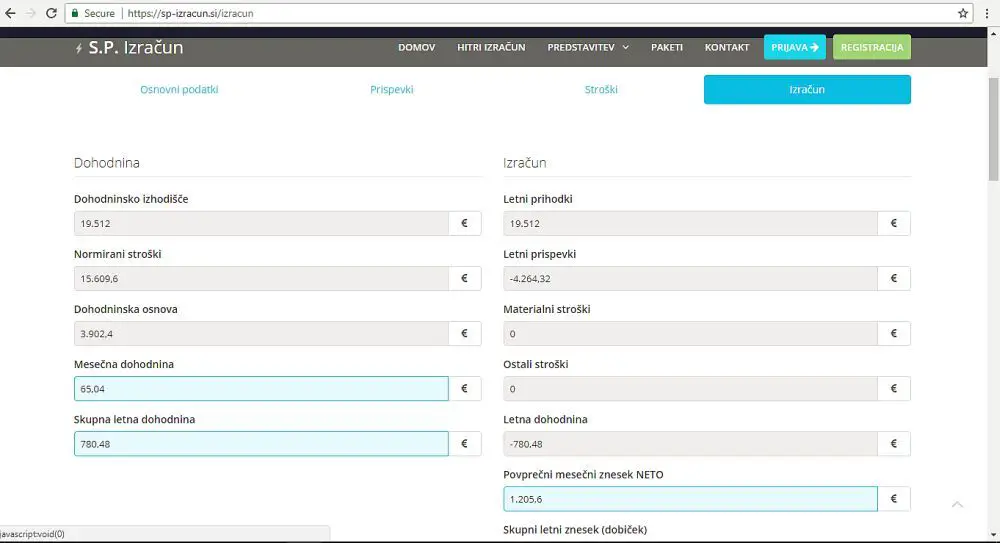

Below is a website which will help you predict your future net income, by calculating and deducting contributions, tax and other expenses you’d like to add to your planning. The website is only in Slovenian, so we will help with some instruction for nSPs and some basic translation. Note that when writing decimals in Slovenian, “,” is usually in place of a “.” in English. For link to the website below click here.

Tick “mesečni znesek” for your average monthly gross income on the left and fill in the amount below. On the right, choose “Normiranec 2018”. Click “naprej”, to get to the next step, which is “prispevki” or contributions.

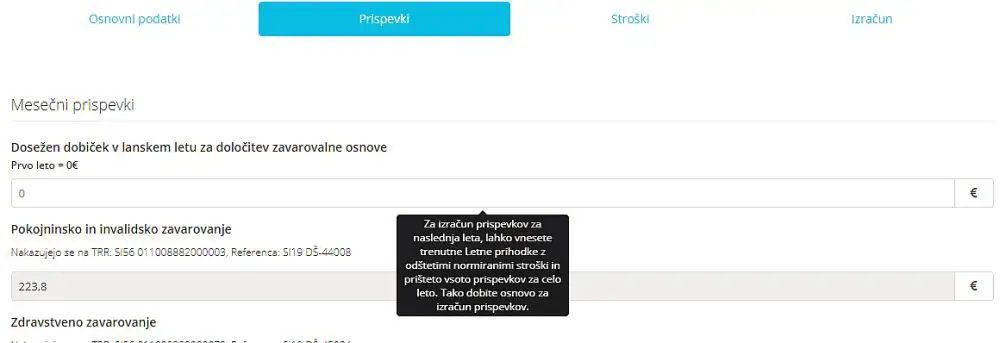

Your contributions are based on previous year’s insurance base (zavarovalna osnova”. If it is your first year in SP, leave “0” in the first line. If not, write in the sum of your previous year’s taxable income (20% of your gross income) and all contributions you have payed including those, paid by the government (50% or 30% of your PIZ contributions). Ignore the rest and click “Naprej” (Next).

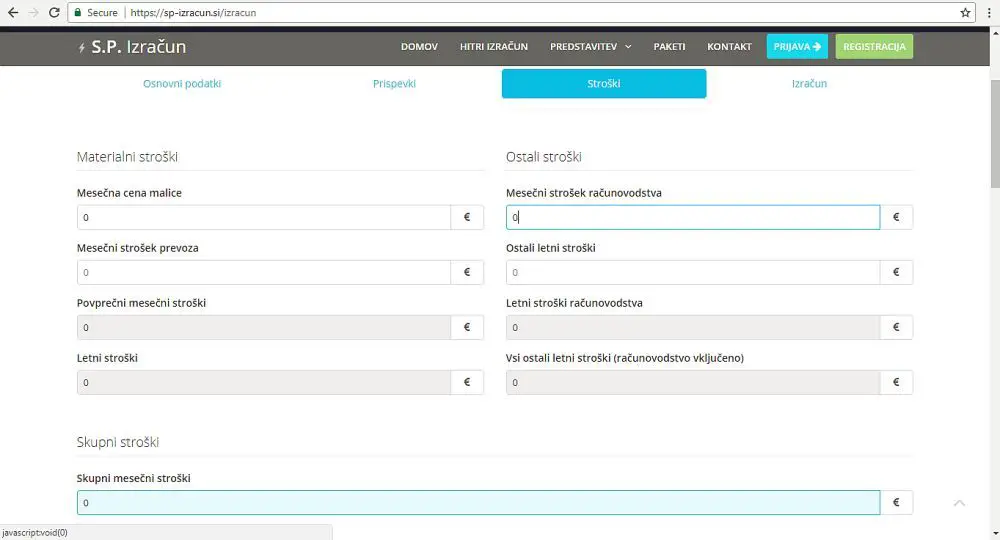

In this third part called “stroški”, you write in all possible additional expenses of your business such as transportation, accountant, etc. that you’d like to deduct from your net income. We were mostly interested in the amount of deductions that are obligations of a nSP to the state, so we marked all these with zeroes. Click “naprej” to get results on your estimated monthly net income (povprečni mesečni znesek NETO).

Good luck!

For more stories like this in your feed, follow us on Facebook